By Jesse Gilbert and Steve Piper

Coal markets moved up solidly during February amid signs of depleted generator inventories and competitive dispatch against natural gas. Natural gas pricing, despite significant volatility, appears likely to support steady coal demand into the shoulder season. Upward price movement was broad, with the NYMEX CAPP prompt-month benchmark gaining nearly 7%, or $4/ton, in February, and NYMEX PRB gaining $0.30/ton, or 2.5%. Higher-Btu Central Appalachian (CAPP) markers added $1/ton to $2/ton, while physical prompt-month markers for Northern Appalachia (NAPP) and Illinois Basin (IB) showed modest gains.

With only a slight easing of winter weather in the eastern U.S., substantial pulls on natural gas storage continued through February causing Henry Hub natural gas spot prices to range between $5/MMBtu and $8/MMBtu. Prices settled near $4.80/MMBtu to close the month, but storage deficits against the five-year average grew to 710 Bcf with five weeks of winter remaining. The storage deficit is unlikely to be less than 300 Bcf at this point, i.e., if withdrawals balance injections through the remainder of winter, which will support natural gas markets above $5/MMBtu whenever weather-related demand makes an appearance.

With coal deep in the money and reverse-switching depleting generation inventories, the market pull for production should be healthy through the third quarter of this year. Coal production has been hampered, however, by the same winter weather that is driving demand, and by bottlenecks in rail deliveries. This raises the prospect that incremental pricing gains will be offset by loss of incremental production volumes that may not be made up over the year.

Regardless, the pricing picture looks better for producers than it has in nearly two years. The chart below shows SNL Energy’s current price forecast for the Powder River Basin (PRB) 8,800 and 8,400 markers.

The above chart shows PRB 8,800 firming above $13/ton over the next two years, as supply constraints and competitiveness against natural gas boost demand compared to recent history. Discounts in the 8,400 grade are wider than observed historically and may shrink as these volumes grow in the PRB supply mix. NYMEX indications for PRB 8,800 are available through 2016, with the SNL Energy long-term forecast results picking up in 2017. By 2016, SNL Energy forecasts that PRB price growth will level off and perhaps decline as export markets mature and retirements in coal-fired generation cut into domestic swing volumes.

The above chart shows PRB 8,800 firming above $13/ton over the next two years, as supply constraints and competitiveness against natural gas boost demand compared to recent history. Discounts in the 8,400 grade are wider than observed historically and may shrink as these volumes grow in the PRB supply mix. NYMEX indications for PRB 8,800 are available through 2016, with the SNL Energy long-term forecast results picking up in 2017. By 2016, SNL Energy forecasts that PRB price growth will level off and perhaps decline as export markets mature and retirements in coal-fired generation cut into domestic swing volumes.

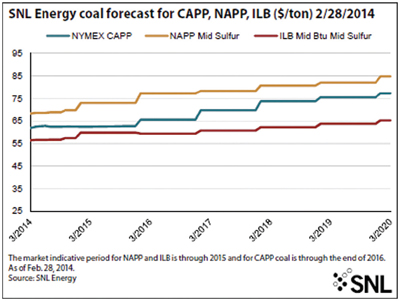

Ongoing improved economics versus natural gas has allowed price growth in spot CAPP coal, and has supported improved coal generation levels. Offsetting the trend, recent upward price moves have eroded CAPP’s margin in export markets, limiting incremental international growth opportunities. The chart below shows the current price forecast for bituminous steam coal. The market-indicative period for bituminous coal markers is through the end of 2016 for NYMEX CAPP and through 2015 for the NAPP and ILB markers.

The last month’s surge in CAPP pricing has reasserted its premium over the IB, as shown in the above chart. These markers are emerging as direct competitors for domestic steam markets and potential export opportunities. SNL Energy expects price growth to be limited going forward by flat overall domestic demand and intra-basin price competition.

Coal Production and Demand

Estimated production levels averaged 18.8 million tons per week year-to-date through February 22, with demand pressure offset by transportation constraints due to winter weather. Production levels on a 52-week moving average basis are even with last year, continuing a modest recovery of production levels. Compared to prospects at the end of 2013, the year appears to be off to a slow start, which may limit the ability to grow overall volumes compared to 2013.

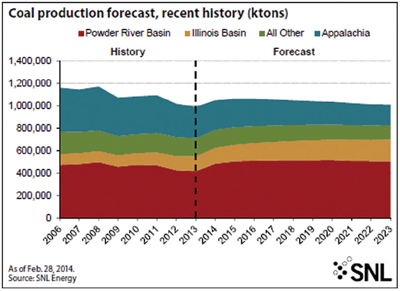

The production chart on page 37 compares SNL Energy’s production forecast with recent history. Appalachian producers closed mines to cut costs and improve competitiveness, but the relative success of this effort is expected to accelerate declines in productive capacity. Customer moves from CAPP to IB should set the stage for production growth in IB to offset CAPP losses. PRB will gain on reverse switching, but at lower levels than anticipated in January.

Production Outlook

Production Outlook

SNL Energy estimates 2013 PRB production (including northern and southern PRB) at 417 million tons, 1.7% lower than 2012 levels. With a significant amount of spare capacity and tighter inventories, production growth of 15% or more is possible, driven mainly by a rebound in domestic steam generation. It should be noted, however, that early indications for 2014 production continue to show recovery of volumes rather than substantial growth. Over the next few years, erosion in the coal-fired generation base may limit growth still further.

IB production grew an estimated 4.7% to 134 million tons in 2013, with prospects for both exports and switching from CAPP creating a relatively favorable demand picture. SNL Energy estimates 2014 production of 142 million tons, or 6% annual growth. New mines at relatively high volumes should enable this growth in capacity at competitive prices versus natural gas and CAPP coal. IB’s production growth should continue over the next four to five years as it gains market share in domestic steam generation, bucking the trend of flattening overall coal demand.

With most Mine Safety and Health Administration (MSHA) quarterly reports in for the fourth quarter of 2013, Appalachian tonnage is estimated at 272 million tons in 2013, which represents a nearly 8% decline from 2012. Steep declines in Central Appalachia were the main drivers, offset by relatively stable Northern and Southern Appalachian production. Eastern producers spent much of 2013 slashing production at marginal mines to achieve a lower cost profile and more sustainable production levels. Production and price results from the last two months suggest that these efforts are beginning to pay off, although the shutting in of mines will result in continued production declines. The looming erosion of core Appalachian markets in steam generation will push producers to focus on high-value export and metallurgical markets, which will form an increasing part of baseline demand. SNL Energy estimates 2014 production at 263 million tons, 3.5% below estimated 2013 levels.

Jesse Gilbert is a senior analyst and Steve Piper is the associate director of energy fundamentals for SNL Energy. www.snl.com