U.S. metallurgical coal exports remained consistent compared to wide swings in U.S. thermal exports. (Chart: EIA)

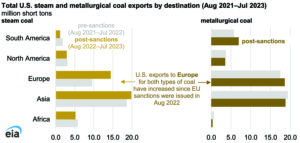

U.S. coal exports increased by 5.7 million tons in the 12 months after European Union’s sanctions on coal from Russia went into full effect in August 2022, according to the Energy Information Administration (EIA). The increase was driven almost exclusively by a 22% jump in U.S. coal exports to Europe, totaling 33.1 million tons between August 2022 and July 2023 compared with 27.1 million tons during the same period prior to the sanctions (August 2021–July 2022).

In 2021, Europe received 84.6 million tons of coal from Russia, about one-third of Russia’s total exports. After Russia’s full-scale invasion of Ukraine in February 2022, the EU responded by imposing sanctions on coal from Russia in April 2022, with a grace period for pre-existing contracts that lasted until August 2022. Once a ban on European buyers purchasing coal from Russia went into full effect in early August 2022, imports of coal from Russia into Europe fell to almost nothing. The U.S. joined other coal-supplying countries, including South Africa and Colombia, to make up the difference. U.S. coal exports also increased to Asia and South America, but declined in Africa, Australia and Oceania, and North America.

U.S. coal exports to Europe jumped after sanctions were announced. (Chart: EIA)

As a swing, or higher-cost, supplier in global steam coal markets, the U.S. was positioned to shift steam coal exports to Europe. For the 12 months after full implementation of the EU sanctions went into effect, from August 2022 to July 2023, U.S. steam coal exports to Europe totaled 14.4 million tons, 51% more than over the previous 12-month period (August 2021–July 2022). This increase and a 6% increase to Asia contrasted with declines in U.S. steam coal exports to the other four continents to which the United States exports steam coal. U.S. steam coal is a comparable quality to that produced by Russia, making it a natural substitute; both countries have premium-quality bituminous coal with a high heating value.

U.S. metallurgical coal exports to Europe rose only 6% (compared with the previous 12-month period) to 18.6 million tons during August 2022–July 2023. U.S. metallurgical coal exports to South America increased, but exports to Africa, Asia, Australia and Oceania, and the rest of North America declined. Exports of metallurgical coal have been more stable because this coal is used strictly to produce iron and steel.

In related news, the World Steel Association recently reported world crude steel production for 63 countries totaled 149.3 million metric tons (mt) in September 2023, a 1.5% decrease compared to September 2022. China produced 82.1 million mt in September 2023, down 5.6% on September 2022. India produced 11.6 million mt, up 18.2%. Japan produced 7 million mt, down 1.7%. The U.S. produced 6.7 million mt, up 2.6%. Russia is estimated to have produced 6.2 million mt, up 9.8%. South Korea produced 5.5 million mt, up 18.2%. South America produced 3.4 million mt, down 3.7%. Africa produced 1.3 million mt in September 2023, down 4.1% on September 2022.