| A longwall shearer operator cuts coal in Poland. (Photo credit: Kompania Weglowa) |

Poland’s coal industry faces a serious crisis. In 2012-2013, market conditions worsened for the largest players as cheap imports applied downward pressure on coal prices. Coal production is declining and becoming less profitable. The level of industry income is falling extremely fast. In the first quarter of 2013, it dropped to PLN 1.7 billion ($556 million) from PLN 3 billion ($982 million) in the first quarter of 2012. The representatives of the largest state-owned coal companies say future coal exports will improve profitability, but that makes no sense, as Polish coal is losing the competition with foreign companies at home.

Poland consumes 77 million metric tons per year (mtpy) of coal, which makes it the 10th largest coal consumer in the world and the second largest in the European Union, after Germany. In 2012, 92% of electricity and 89% of heat in Poland was generated from coal and, according to the official Polish Government Energy Policy Strategy, coal should remain the key element of the country’s energy security until at least 2030.

Despite all attempts by the government to stop it, production levels have been falling steadily since 1989. Today, Polish coal operators produce 60 million mtpy of brown coal and 70 million mtpy of black coal. The coal industry failed to adapt to capitalism. During socialism, the state usually paid for coal at a much higher price than it actually costs to produce. However, those days are gone and today experts agree that Polish coal miners will be unable to escape this cycle.

The problem is that coal seams in Poland are too deep to mine cost effectively. By 2030, there will be no more than 10 to 15 working mines in Poland, and production of black coal will drop to 33 million mtpy.

Representatives of the Ministry of Energy are seriously concerned about the situation. According to official statistics, coal mining costs increased by more than 5% last year, while thermal coal prices in the region dropped by more than 12%. Coal sales have dropped more than 5% during the first half of 2013 compared to the same period of 2012. As of September 2013, the level of stockpiles reached record heights of 9 million mt.

According to the ministry, Poland will continue to burn coal until 2050, despite the domestic situation. So with an insufficient level of domestic production, Poland will import. “We cannot work without coal. So it is time to begin the work that will guarantee Polish coal in the long term. If we do not have it, then we will be forced to import coal from abroad,” said Maciej Kalinski, director of the Mining Department of the Ministry of Economy of Poland.

There is also a prevalent political fear. Becoming dependent on coal imports to Russia could put Poland in a similar situation as Ukraine, which is dependent on Russian gas. Poland may find the situation hard to avoid as Russian companies increase production and coal exports.

| Synthetic Picture of the Coal Industry in Poland Since 1990 |

|

Should Poland Invest?

The government still has not decided if it should allocate any additional support for the existing coal mines to modernize and purchase new equipment, as well as for construction of new mines. Researchers in Krakow have developed two different future scenarios for the country’s energy needs with and without state support for coal industry.

In one scenario, the government invests in the construction of new mines. The country will be using about 50 million mt of brown coal (up to 2035, consumption could reach 86 million mt) and 44 million mt of black coal produced domestically.

The other scenario does not provide any increase in investment in coal mining. By 2050, Poland will stop production of brown coal while black coal mining in Poland will amount to 22 million. Consequently, 44 million mt of black coal and all brown coal, according to this scenario, will have to be imported to Poland from abroad.

According to experts, the demand for coal in Poland to 2050 will exceed the current domestic production capacities, and therefore, new investments in coal mining are required. The study emphasized that there is no possibility of replacing coal with natural gas as it has no reserves.[Editor’s note: This seems unusual considering the amount of deep coal reserves.]

The government will decide on this issue in a couple of years. In the meantime, experts noted that Poland will have a strained economy will little money to invest in an unprofitable sector of the economy. At the same time, the Polish government continues to invest in a restructuring program, which is conducted by the Spółka Restrukturyzacji Kopalń S.A. (SRK). The aid program granted to SRK finance closure and post-closure activities and the payment of benefits to former employees of those mines.

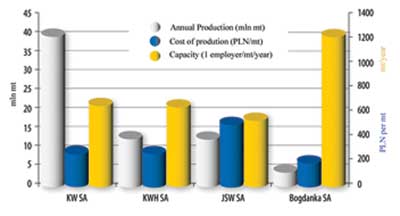

| Indicators Characterizing the Largest Coal Mining Business in Poland |

|

Polish Coal Operators

After the fall of socialism, all coal mining companies in the country were state-owned. During the last 20 years, the government launched several restructuring programs aimed to decrease the level of mining and improve the profitability of the companies. The programs have provided for the partial privatization of the mining companies. Today, it is operating several main coal mining companies including state-owned Kompania Węglowa SA — the largest coal producer in Europe, Katowicka Grupa Kapitałowa SA and two private companies: Jastrzębska SW SA and Lubelski Węgiel Bogdanka SA. These four companies account for about 92% of all coal mining in Poland.

Kompania Węglowa SA (KW) accounts for about half of coal mining in Poland and is suffering serious losses. The company ended the first half of 2013 with losses of about $31 million. The head of the KW suggested, based on the first half performance, that the balance for the year also will be negative.

According to the Ministry of Economy Affairs, in the first half of 2013, the price of thermal and coking coal of KW and Katowicki Holding Węglowy (KHW) significantly decreased, which cut the income of both companies. The average price of coal for both companies during the first half of 2013 was $86.25/mt, reflecting a decrease of more than 12% over last year.

Since early September 2013, KW vigorously implemented a so-called adaptive plan that will help the company deal with the tough financial situation. One of its goals is to restructure the Piekary and Brzeszcze mines, which are unprofitable. In the long term, the goal of the company is simple, it will close all mines that gain no profit or have too low of a profit, leaving only the most valuable mines. In September, the company started to transfer miners and equipment from the Piekary mine to the Bielszowice mine. In October, 87 miners from Piekary were transferred to the work in the Pokój and Bobrek-Centrum mines.

By 2020, KW plans to shut down half of its mines — so their number will decrease from 15 to eight. With this step, the volume of coal mining for the company is projected to drop from about 38- 40 million mt in 2012 to about 25 million mt in 2020. At the same time, during this period, the company may increase the volume of coking coal mining. In 2012, KW produced 2.3 million mt of high valuable coking coal (type 34). During the coming years, KW plans to allocate the largest part of all investments for that period to coking coal mines so the volume of its production should rise by 3.2 to 3.5 million mt until 2020.

KHW and Jastrzębska Spółka Węglowa (JSW) currently have almost equal shares in Polish coal production. The annual volume of production of KHW is about 12.8 million mt and JSW produces 13.3 million mt. Both of these companies are dealing with almost the same problem as KW. However, JSW is the largest producer of coking coal (type 35). By 2020, the volume of coal mining of these companies will also drop, so KHW will produce about 5-6 million mt of coal, while JSW will mine about 9-11 million mt of coal with the main focus on coking coal.

Lubelski Węgiel Bogdanka is the largest private company and has consistently implemented its business plans, which says it should have about a 20% share of the market of thermal coal in Poland by 2015. The main active mine is the Bogdanka coal mine, which is a large mine in eastern Poland, about 197 km southeast of Warsaw. Bogdanka represents one of the largest coal reserves in Poland having an estimated 265.3 million mt of coal. Annual coal production is currently 7.5 million mt.

In addition to the relatively small amount of coal production, about 5.8 million mt in 2011 and 7.8 million mt in 2012, Bogdanka is the most modern mine and has the highest level of productivity. It is the largest coking coal producer not only in Poland, but in all of Europe. According to its own estimates, the volume of investments in modernization and upgrading at the technical level and infrastructure in 2007-2014 should reach PLN 600 million (US$197 million). It is the only coal company in Poland that reported strong revenue and profit indicators for 2013.

Further Privatization

Further privatization might be one of the best ways to rescue the other failing coal companies. Up until 2009, all of Poland’s coal mining companies remained fully owned by the state treasury, until Bogdanka became the first coal-mining company to be privatized when it was listed on the Warsaw Stock Exchange. Poland’s accession to the European Union around this time and the subsequent obligations to abide by state intervention rules forced the treasury to speed up its restructuring efforts. The government now has a stated aim to fully privatize all coal-mining companies in the coming years.

JSW was partly listed (33%) on the stock exchange in 2011. It is regarded as one of the better run mining companies in Poland with reserves of good quality coking coal and a well-established customer base. JSW sold 5 million mt of coking coal in 2011, and it has substantial coking facilities of about 3- to 4-million-mt capacity.

The realization of a fully privatized coal mining industry still faces many challenges. The task of effectively restructuring KW and KHW should prove much more difficult to accomplish compared to JSW or Bogdanka. Both of these companies have very strong and influential trade unions and they are producing thermals coal, which do not command the same prices as coking coal.

Based in Moscow, Vladislav Vorotnikov is a freelance writer who specializes in heavy-industry trade reporting. He contributes regularly to Coal Age and can be reached at: vorotnikov.vlsl@gmail.com.