Third-party consultants offer much-needed objective assessments of reclamation project plans and designs

by jesse morton, technical writer

Partnering with an engineering consultant on reclamation plans pays dividends. The right consultant can assess plans for efficiency, and help generate cost-cutting measures. It can assess a bonding arrangement for cost-effectiveness, and make sure it is futureproof. It can help ensure geotechnical engineering designs meet today’s regulations, and that a reclaimed impoundment handles the storms of tomorrow.

Examples from the field show both the tangible and intangible benefits of contracting a consultant.

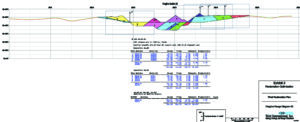

An excavator dragline range diagram generated by WEIR International to support equipment utilization assessment report findings. (Image: WEIR)

Helping Optimize Reclamation Project Plans

WEIR International reported it completed a reclamation optimization project for a Texas surface mine that led to estimated cost savings of an astounding 20%. The project was completed on time, on budget and remotely.

WEIR was brought in to do a reasonableness review of the reclamation plan, and after some initial brainstorming, was signed for further analyses and to deliver an optimized cost schedule. Deliverables included a report and supporting exhibits.

Previously, WEIR had done other operational and reclamation reviews for the miner, described by WEIR as a great client that was eager to collaborate. “Sometimes it takes an outside look at an existing plan, and then thinking about it in terms of what could be improved,” Fran Taglia, president, WEIR, said. “The client already had a good, solid reclamation plan.”

Company literature shows WEIR has broad experience doing operational assessments, which hinge on open communication and cooperation with the customer. “It requires good liaison between client and consultant to determine which direction to pursue in the end,” Taglia said.

“Our most successful work is done when we get to work closely with the local teams of engineers, geologists and operators,” he said. “We can quickly determine which ideas have been tried or tested and what might be a novel option worth investigating.”

Over the past decade, WEIR has completed several reclamation optimization projects. “The results were similar, as we were able to identify design and operational improvements that resulted in significant cost savings for the clients,” Taglia said. “Other projects have also included targeting permit modifications to adjust the actual reclamation footprint and post-mining topography.”

The Texas mine is on the Calvert Bluff Formation of the Wilcox Group in the Gulf Coast Lignite Region. The seams in the region range from 5 to 10 ft thick and run through unconsolidated sands and silts. “Seam splits are common but not pervasive and can cause operational challenges,” Taglia said. “Like most other surrounding mines, the primary movers at this mine are draglines.”

WEIR has previous experience mining in the region. “WEIR’s consultants also have valuable experience in coordinating with the state regulatory agencies, which helps in many different ways, perhaps most importantly in determining the approaches that are most likely to obtain approval,” Taglia said.

Going into the project, WEIR anticipated the big challenges would be the “validation of material balance, analysis of the client’s cost model, and then finding ways to save on costs,” he said.

The plan was to divide the area into sections and then conduct analyses on each. “This approach has worked well for us in the past,” Taglia said.

“Most volumetrics were performed on gridded surfaces that were created from triangulations derived from the sections,” he said. “The iterative process involved allocating cut-fill material to the different equipment types based on unit cost and their capability.”

The project spanned two months. WEIR analyzed equipment utilization for optimized material movement, produced detailed dragline range diagrams for assessing rehandle limits, and evaluated suitable plant growth movement plans. Taglia said it was done “entirely virtually” and used video conferencing, online sharing, and aerial drones for imagery and data.

For the sectional analyses, WEIR generated dragline range diagrams for use in assessing rehandle limits.

“To get an accurate representation, we have found that sections on around 300-ft centers provide enough detail,” Taglia said. “Of course, around ramps and irregular areas, you may need to decrease this. It depends on the consistency of the current topography.”

The numerous range diagrams went through an iterative process, he said.

“The maximum rehandle you can sustain on a particular section is highly dependent on the initial dump area geometry,” Taglia said. “You can see that a shallow initial dump depth would result in a dragline being able to take less material on a section.”

Based on the geometry, the optimum rehandle was estimated to be 110% prime, with the dragline doing the bulk of the earthmoving.

The findings jibed with the equipment utilization assessment. “However, some of the areas were not suitable for some equipment types,” Taglia said.

“For example, some spoilside borrow areas were too risky for the dragline. The client’s operations personnel were great at providing input for this,” he said. “Also, some discreet areas, like final drainage channels, had to be allocated to truck-shovel.”

The equipment utilization assessment showed dozer pushes would be good up to about 400 ft. “You can only push it so far before rehandle catches up,” Taglia said. “Of course, a dragline is usually the cheapest dirt.”

The best place to dig was from the top, he said. “This avoided overhand and associated dragline ramping, even though it slightly increased the rehandle required to get down to final grade,” Taglia said. “In addition to some adverse areas, the remainder had to go to truck-shovel, the most expensive dirt.”

WEIR concluded the dragline should move roughly 75% of the material. “The dragline robbed most of the material from the dozers, and that is one of the aspects that contributed to the need for iterations to get an optimal solution since dozers can move material at a low cost too,” Taglia said. “Truck shovel material was significantly decreased, which helped decrease overall costs.”

With feedback from the miner validating the conclusions, WEIR recommended increasing dragline yardage and reducing the amount of dirt moved by truck-shovel fleets. “Some final design modifications to final drainage were also recommended,” Taglia said.

The miner adopted the recommendations. “Significantly more material movement was allocated to the dragline versus originally budgeted,” Taglia said, “and estimated reclamation costs were reduced by 20%.”

Of the lessons learned, perhaps foremost is that the balance between cost and dragline distances to final pit backfill is not linear, he said.

“Once a certain distance is exceeded for a dragline to place material in the final pit backfill, rehandle goes up almost exponentially and, of course, so do costs,” Taglia said. “It is crucial to identify the inflection point on that cost curve.”

Completion of the project remotely, on time and on budget, ultimately required expert knowledge of mining equipment, engineering and geologic modeling software, the regulatory environment, and mining operational best practices. It, and the resulting value-adding recommendations, can be duplicated at other sites willing to partner and keep an open mind, Taglia said.

Helping Save Money on Reclamation Costs

Stantec reported an acquisition opportunity review it completed for a potential buyer of a multi-mine-site company contained recommendations offering potential savings of up to 35% on the reclamation bond amount.

The acquiring company partnered with Stantec for a due-diligence technical evaluation of the purchase. The primary deliverable was a report providing an “understanding of the geology, of the engineering and life-of-mine plans, and of all of the physical infrastructure, meaning offices, shops, dragline, the underground equipment, conveyance, load centers, rail, of all of the components of the mine site,” Greg Gillian, sector leader, mining, Stantec, said.

“When operators are acquiring other operators, they want to understand the conditions, the planning and the people that are involved in it. They also need to understand the risks of acquiring the operation,” he said. “Risks are usually characterized as having potential for negative impacts. But for every risk, we like to think there is an opportunity there, too.”

The project sites were in Colorado, New Mexico and Wyoming, and time constraints mandated that Stantec immediately deploy personnel. “The big challenge here was ramping up in short order,” Gillian said. In the course of a weekend, people were notified and put on planes. “Boots were on the ground” by Monday, he said.

Personnel deployed included, but were not limited to, experts in geology, mining, operations and coal quality. Stantec mobilized quickly by tapping personnel from the regional offices of closest proximity to the project sites.

“We could draw upon our resources in multiple offices,” Gillian said. “If there was a geologist in Denver who was best suited and who could get to the project site in Colorado, they were sent,” he said. “If there was somebody on the environmental side out of our Salt Lake City office who could get on a plane and go, then that was the right decision.”

The resulting report was delivered on time and on budget. It assessed “those different technical disciplines or subjects of interest: geologic risk, suitability of mining method, mine plan evaluation and comments, coal quality considerations, processing and handling techniques, staffing and manpower, and then ultimately their business plan,” Gillian said.

“In that report, we provide our opinions on the risks and the opportunities based on our findings and our understanding of the project,” he said.

The findings on the reclamation bonding arrangement contained an opportunity to reduce the amount of the surety posted and the reclamation bond cost. “That was recognized through assessing the bond calculation method and the assumptions,” Gillian said.

“We went in and looked at the calculation that was done and updated that to best practices from our experience, and that includes using some of the operator-owned equipment instead of adopting a contractor-based process,” he said.

It also included using equipment costs based on actual results instead of equipment-cost guides.

“In our case, like with most operations, you’ve got large earth-moving equipment, draglines, scrapers that are suited for large volumes of reclamation,” Gillian said. “They mined it in the first place. They will be well-suited to reclaim it at the end of mine life.”

The plan proposed by Stantec could not only improve free cash flow, but reduce the bond amount.

“We sat with the operations people as well as the bondholding agency and made a positive impact by as much as 35%,” Gillian said. “Stantec was able to add value to our client through engagement of several of our technical and subject matter leads, including environmental, reclamation, mine engineering and mine management.”

Due-diligence assessments and other similar projects are staple items for Gillian’s team at Stantec. More recently, the team completed a market analysis project for a federal permitting agency.

The agency had previously contracted Stantec for valuation reports for specific mines. This time it was looking for information on a region that would allow it to right-size and future-proof.

“We hear about a lot of challenges to coal these days,” Gillian said. “Our government is truly trying to be a partner and understand places where they may be able to streamline or modify their approach to handling projects that come in front of them.”

The agency contracted Stantec for a report forecasting future coal market trends for the western U.S. The project launched in Q4 2019 and concluded in Q2 2020. To complete it on time and on budget, Stantec had to compile data, organize and assess it, and draw conclusions. The findings would have to speak to eventualities that could be as far as a decade or more on the horizon.

Stantec personnel are experts with deep experience in the coal sector and who have developed broad perspectives that reach well beyond those found in the headlines of the day, he said.

“Some of our team that was engaged on this project are former mine operations general managers and were involved in operations in the western U.S.,” Gillian said. “That is unique to Stantec. There are other consultancies that don’t have this.”

Stantec concluded that the current challenges to coal are transitory. “Yes, there are downward trends at the moment. Longer range, there are opportunities here,” Gillian said.

“There are still bright spots in the coal industry. In the future, the industry will look significantly different than it does today, but coal will still be produced. The next impetus will be the next best-use for the resource,” he said. “There are still reasonable high-quality coal reserves in the western U.S. to be mined. There is still access available.”

The report proved to be a win for the agency, which will use it to support decisions in an upcoming project for streamlining the coal-leasing process. “The information was used to ensure that their future approach was streamlined to the fullest extent possible,” Gillian said.

Above, a reclaimed site in Appalachia for which SynTerra provided consulting services. Farm out reclamation project engineering work to help avoid litigation down the road, the contractor says. (Photo: SynTerra)

Helping Geoengineer Impoundments

SynTerra reported seeing demand for consulting services on potential coal refuse impoundment reclamation projects. Miners at any stage of a project can benefit from an expert third-party perspective, and hiring a qualified engineer to develop plans can be the difference between long-term success and litigation-fueling failure down the road, said Charlie Bishop, senior geotechnical engineer, SynTerra.

“Reclamation of a fine coal slurry impoundment or any fine waste impoundment is a significant undertaking requiring serious evaluation as to what is the best long-term plan for the site,” he said.

The main options are keeping it as a slurry impoundment for future use, draining it and then covering it, or converting it into a freshwater lake.

Keeping it for future use is viable if it contains resources that could someday be in demand. Mothballing an impoundment is a big job, Bishop said.

“The future of idled and abandoned impoundments needs to be evaluated regarding the potential for future utilization,” he said. “The interest in rare earth elements recovery from waste coal has identified these impoundments as a future resource.”

Like any other asset, an idled impoundment has to be managed, maintained and monitored. All three require plans, expertise and equipment. “Impoundments that have no potential for future use should be closed and reclaimed,” Bishop said.

Options include conversion into land and conversion into a lake. Increasingly, there is interest in the former for use by solar farms, said Steve Gardner, vice president, special projects, SynTerra. “While structures cannot be built on the closed impoundment areas, they could be used for solar facilities,” he added.

Converting an impoundment into land for such usage “generally takes the form of breaching the dam embankment, dewatering the pool and covering the fine refuse slurry to allow vegetation to be established consistent with the post-mining land use,” Bishop said. “Challenges associated with dewatering and covering the slurry pool include having an adequate volume of material to fill in the pool and provide a regraded surface, which will drain.”

Coarse coal waste can be used. “Having an adequate volume of topsoil or topsoil substitute to cover the surface can be a challenge,” Bishop said.

A slurry of ultra-small fines below the growth substrate presents other challenges. “If the preparation plant was set up for fine coal recovery and was producing a slurry finer than the No. 325 screen size, there are problems associated with the slurry displacing when the cover material is placed,” Bishop said.

“There is also an equipment and operator safety concern,” he said. “Detailed plans, techniques and monitoring is required to safely cover the slurry.”

Any plan for converting an impoundment into land must include the creation of a surface topography that properly drains water into ditches. “The contouring needs to be uniform to provide sheet flow and to limit erosion,” Bishop said. “Ditches need to be sized to become permanent surface streams capable of handling the mandated storm event.”

To meet permitting requirements, ditches will have to be able to handle the runoff from once-a-century-sized storms and other probable maximum precipitation (PMP) events. “Considering the increasing intensity and frequency of storm events, the permanent ditches should be conservatively designed,” Bishop said.

Previously, Bishop said that, a generation ago, designing ditches might have been done inhouse by the miner. More recently, after major advancements in soil science and structural engineering, with big storms becoming bigger news, and with the upwelling of increasingly litigious anti-mining activism, the trend is to farm out the job to the pros.

Depending on the terrain, the expertise required to craft such designs belong to a geotechnical engineer with an advanced degree and more than a decade of experience in the field. Designs that err on the side of caution and that meet permitting specs can fill a filing cabinet.

Such could be the case whether designing ditches for a site in a highlands rainforest in Appalachia or for converting an impoundment into a freshwater lake in a temperate woodland in Indiana.

A well-designed freshwater lake could provide a public or industrial water supply, Bishop said. It could be the primary centerpiece of a park or recreational area.

For converting an impoundment into a freshwater lake, among the topmost things to measure and model is seepage, he said.

“Seepage water discharging from the internal drain would have to be of acceptable quality, not requiring treatment,” Bishop said. “Increased water storage depth will result in increased seepage, and a water quality problem would be unacceptable.”

Of course, dam embankment and spillway structures have to comply with state dam safety regulations and requirements. “Investigation and analyses would need to be done to confirm compliance,” he said.

Such an investigation would require elite expertise on the law and on generating the required construction documentation. “Analyses would include seepage, slope stability, hydrology, spillway hydraulics and storm routing,” Bishop said.

Modification to an existing dam or spillway could range from nothing required to significant earthmoving, depending on the watershed area, he said.

“The evaluation should look at the watershed area and characteristics to determine if the pool water level over the slurry will be maintained during the dry seasons,” Bishop said. “The owner of a freshwater lake needs to be aware of the long-term maintenance and monitoring requirements to meet state dam safety regulations.”

There are scores of aging impoundments in the Appalachian and Illinois coal basins for which tough reclamation-related decisions will have to be made in the near future. Failure to do so comes with consequences, Bishop said.