The best picture for U.S. coal markets for 2014 would be sustaining the momentum the industry experienced during the second half of 2013. Last year turned out better than expected. Total production numbers are down, but they are not down as far as they could have been. Utility consumption of coal grew at a healthy clip starting in the second half of 2013. Spot prices for some coals have also increased. With natural gas prices sitting at a healthy level, the stage has been set for a modest rebound in 2014.

Even though equities on the New York Stock Exchange have reached historic highs, the U.S. economy — as far as job creation for the manufacturing, industrial and construction sectors — has still not improved substantially. Neither has the demand for electricity. Coal as a baseload fuel for power generators won back market share by being competitive with natural gas for the moment and the natural gas futures signal that this trend will likely continue.

From a regulatory standpoint, nothing has changed. President Obama’s “War on Coal” rages. There is talk among coal-state politicians, but talk is cheap. The Environmental Protection Agency (EPA) has steam rolled future coal-fired power generation and is now setting its sights on existing installations.

Every January, Coal Age publishes its Annual Forecast based on a survey of its readership. The informal study gives an assessment of the current market situation, as well as the state of mind among coal operators. Using that information, and data from the leading coal companies, the Energy Information Administration (EIA) and the Edison Electric Institute, Coal Age tries to make an informed decision about future market trends.

Last year’s Annual Forecast predicted a decrease by 4% for 2013 or 41 million tons from 1,016 million tons to 975 million tons. Total U.S. coal production fell by 2% in 2013, or 21 million tons, to 996 million tons. While this is not great news, it beat the forecast and observers should not lose sight of the fact that the U.S. still mined nearly 1 billion tons of coal last year.

In addition to supply and demand fundamentals, the survey asked coal operators about their feelings, the amount of money they plan to spend this year, and how they intend to spend it. Coal operators are unhappy, but they are less pessimistic than they were last year. More of them have more money to spend on capital projects this year.

In addition to supply and demand fundamentals, the survey asked coal operators about their feelings, the amount of money they plan to spend this year, and how they intend to spend it. Coal operators are unhappy, but they are less pessimistic than they were last year. More of them have more money to spend on capital projects this year.

The survey also asked them to rank issues affecting the industry. A similar open-ended question, designed to identify possible overlooked issues, elicited an overwhelmingly similar set of responses that singled out the Obama administration, the EPA and other federal agencies as trying to drive the coal industry out of business. They are taking it personal and the mood can be best summed up as somewhere between anger and shocked disbelief with the lack of a sound energy policy from Washington.

Investments Are Being Made to Reduce Operating Costs

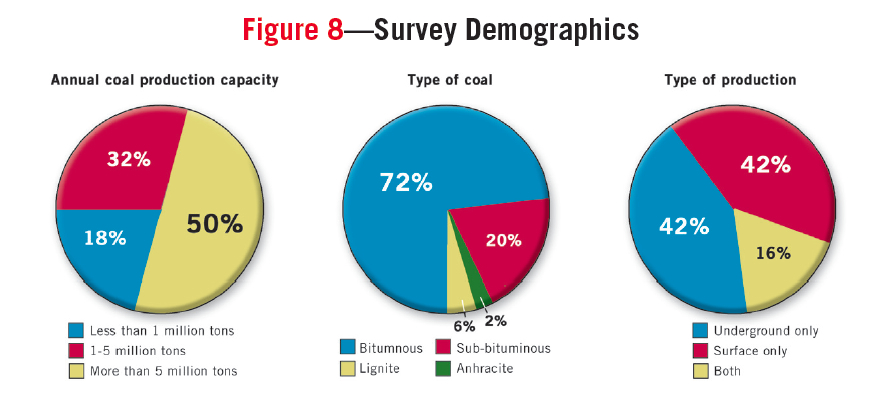

Coal Age contacted 500 coal executives and received 58 completed surveys. The demographics largely resemble the U.S. coal industry. The majority of them (72%) produced bituminous coal. Subbituminous, lignite and anthracite accounted for 20%, 6% and 2%, respectively. As far as production capacity, most of the respondents represented large mine operators (more than 5 million tons, 50%), followed by medium (1-5 million tons, 32%) and small (less than 1 million tons, 18%); 42% described themselves as underground coal operators exclusively, while 16% said they only operated surface mines. The remainder (42%) said they worked for a company that mined coal using both surface and underground techniques. Similar to years past, most of the respondents said their coal went to electric utilities (76%). The remainder said their coal was destined for steel mills (16%) or industrial boilers (8%). Steam coal is the overwhelming use for the majority of U.S. coal production.

Going into 2014, coal operators are less pessimistic than they were last year. A total of 60% described their attitude as negative, while 18% were more optimistic. Last year, a whopping 73% of the respondents said they viewed 2013 with pessimism. Only 10% of the respondents were optimistic.

Going into 2014, coal operators are less pessimistic than they were last year. A total of 60% described their attitude as negative, while 18% were more optimistic. Last year, a whopping 73% of the respondents said they viewed 2013 with pessimism. Only 10% of the respondents were optimistic.

Of the executives surveyed, 43% thought coal production would decrease in 2014, while 21% felt production would increase and 36% said production would remain the same. In 2013, 48% felt a decrease in 2013, while those seeing it stay the same or increase were evenly divided. Basically both groups that saw a change in the market, whether it was an increase or a decrease, decreased 5%. Those seeing it stay the same grew 10%. Looking ahead to 2015, 52% of the respondents see the market staying the same while 33% see it decreasing and 25% see it increasing.

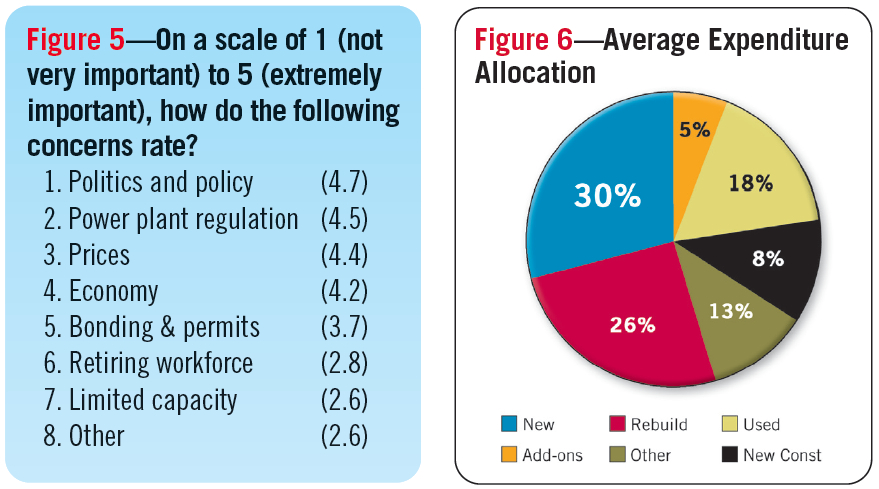

A question regarding productive capacity also showed a moderating attitude (See Figure 4). A total of 60% of the respondents thought their mines would run at less than 90%, which is down from 79% last year — a 10-year high. Several conclusions can be drawn: the industry worked through a period of over capacity, the market improved or all of the above.

Coal mining is a capital intensive business. For 2014, 24% reported an increase in capital budgets, compared to 17% last year. The respondents seeing a decrease stayed the same: 56%. So capital budgets improved toward the increase and the amount of people seeing their budgets staying the same decreased. When asked how they would spend the money, they said equipment upgrades (58%), new equipment (54%), mine development (49%), permitting (39%) and used equipment (30%). Equipment upgrades have taken a priority over new equipment for three consecutive year now. When asked how their money would be allocated on a percentage basis, the majority of the respondents said 30% of their money would be spent on new equipment and 26% would be spent on equipment rebuilds (See Figure 6).

When asked about their capital budgets, 33% of the respondents reported they would spend less than $10 million this year. A total of 20% said they would spend more than $100 million; 15%, $10-$25 million; 17%, $25-$50 million; and 15%, $50-$100 million. Those that are going to spend are going to spend more. This year 52% will spend $25 million or more. Last year that figure was 32%.

When asked about their capital budgets, 33% of the respondents reported they would spend less than $10 million this year. A total of 20% said they would spend more than $100 million; 15%, $10-$25 million; 17%, $25-$50 million; and 15%, $50-$100 million. Those that are going to spend are going to spend more. This year 52% will spend $25 million or more. Last year that figure was 32%.

Coal operators expressed a lot of frustration in the survey. When asked: What will affect the U.S. coal industry the most and how should it prepare? Many of the responses cited the EPA’s “War on Coal” and referred to the Obama Administration. A significant group said low natural gas prices. Many had constructive ideas on how to prepare. A sampling of several of the responses, which were fit for publication, are offered anonymously on page 27.

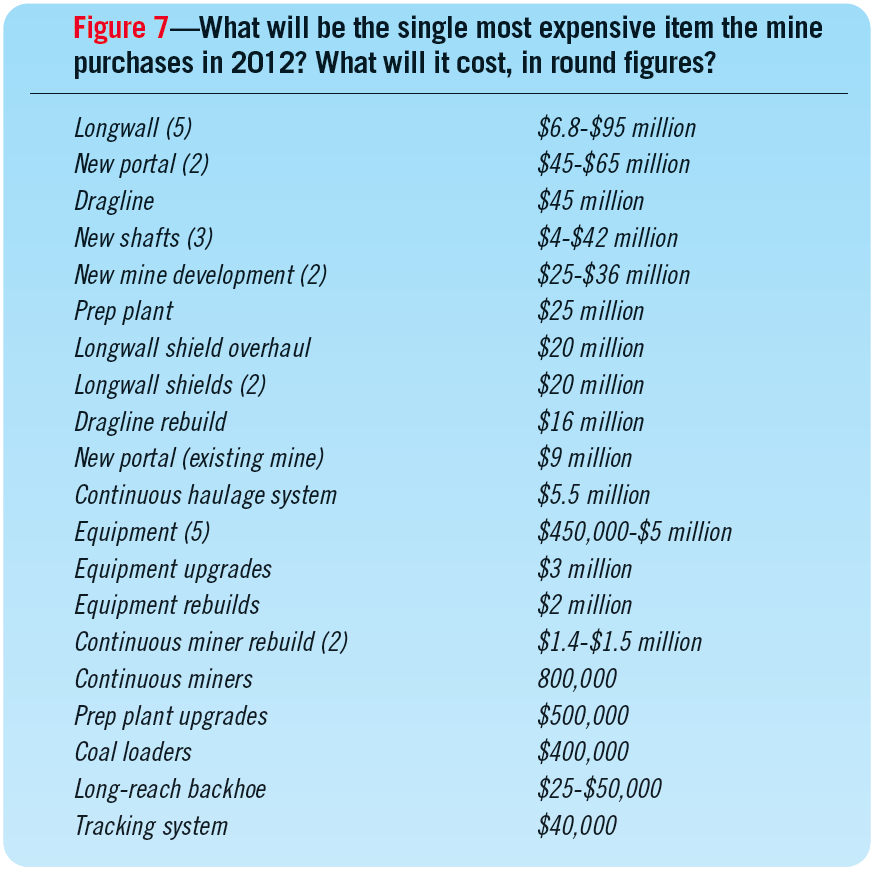

When asked about what specific issues will affect the coal industry the most in 2014, politics and policy displaced power plant regulation as the leading concern. Coal prices overruled the economy. Reading between the lines, the miners are saying that prices and the economy do not matter if their customers are not allowed to burn coal. Limited production capacity was the least of their concerns.

Domestic Market Improves, While Exports Soften

Domestic Market Improves, While Exports Soften

Total U.S. production for 2013 totaled 995.8 million tons, 2% lower than 2012, which was 1,016 million tons. This is the first time total coal production has dropped below the 1-billion-ton mark in 20 years.

A 21 million drop in production sounds significant, but it pales in comparison to the 73-million-ton decline between 2011 and 2012. The bleeding has not stopped, but it’s safe to say the industry has stabilized from a freefall situation. Central Appalachian (CAPP) coal production declined by 10 million tons, or 7%, year-on-year in response to weak demand. Coal production from the Powder River Basin (PRB) declined by 8 million tons, or 2%, year-on-year as operators reduced production because of weak prices. The Illinois Basin (ILB), Northern Appalachian (NAPP) and Western Bituminous coal production all increased, with ILB growing the most (6 million tons, or 5%).

The good news amidst all of these figures is that the utility coal burn is increasing. Utility coal consumption accounts for about 85% to 90% of U.S. coal production. At the end of the third quarter 2013, utilities had burned 649 million tons, compared to 614 million tons in 2012 and 723 million tons in 2011. That’s an increase of 5.7% or 35 million tons. While no one’s sure of the new norm, total 2013 consumption could be somewhere in the range of 870 million tons, compared to 824 million tons in 2012 (the lowest amount since 1992) and 932 million tons in 2011.

The gains that coal made in 2013 were at the expense of natural gas. Prices for natural gas increased during 2013, creating a shift back to coal in some regions. For the year, the prices utilities paid for natural gas remained above $4 per 1,000 cubic feet (Mcf). In May 2013, they climbed as high as $4.79/Mcf before dropping to $4/Mcf in August. As of October, they stood at $4.26/Mcf.

The American economy is powered by electricity and electrical demand will only increase significantly when America experiences a true economic recovery and the manufacturing sector begins to grow again. In the meantime, utilities have excess capacity and they can play the spot market to hold costs down for their customers, pitting coal against natural gas. In some areas the transition to gas from coal has been more pronounced.

The region with the largest shift between coal and natural gas in terms of both the overall generation levels and the relative fuel mix has been in the Southeast, according to the EIA. Competitive natural gas prices, a concentration of highly efficient natural gas-fired generators, and the high cost of shipping coal from the mines have all contributed to this shift. Coal-fired generation rebounded modestly in 2013 as natural gas prices rose above their 2012 levels, but coal is still contributing less than 50% of regional generation this year, which is a dramatic shift from 2001-2009.

The region with the largest shift between coal and natural gas in terms of both the overall generation levels and the relative fuel mix has been in the Southeast, according to the EIA. Competitive natural gas prices, a concentration of highly efficient natural gas-fired generators, and the high cost of shipping coal from the mines have all contributed to this shift. Coal-fired generation rebounded modestly in 2013 as natural gas prices rose above their 2012 levels, but coal is still contributing less than 50% of regional generation this year, which is a dramatic shift from 2001-2009.

At the end of September (latest stats available), coal stockpiles at utilities stood at 152 million tons, the lowest level in two years. For the last year, coal inventories had remained steady between 170 and 185 million tons. During the summer of 2013, utilities drew the level down roughly 18 million tons from 170 million tons at the end of the second quarter.

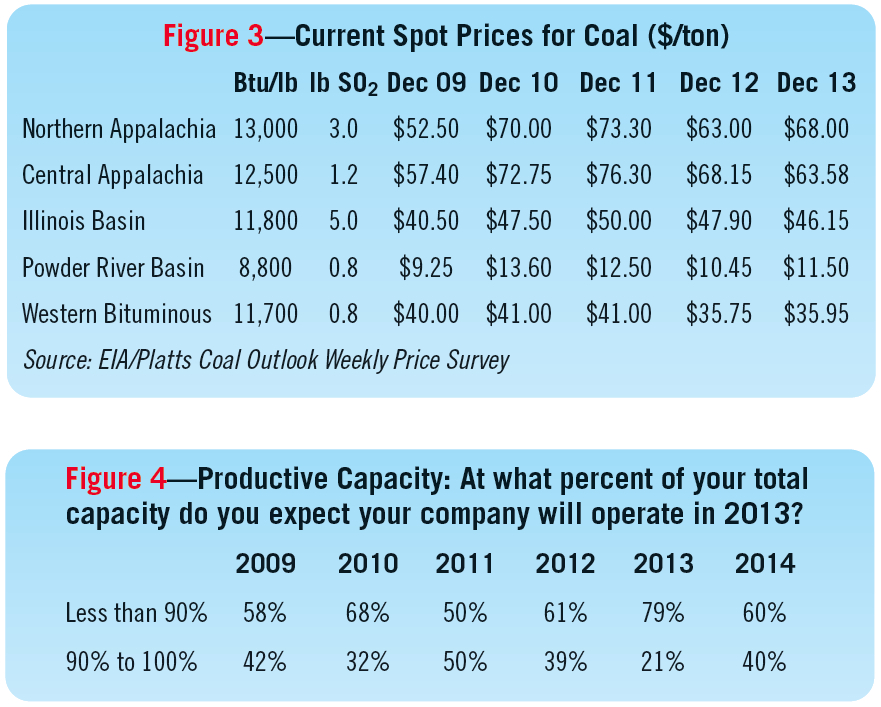

For the most part, prices for prompt delivery of coal (spot prices) have reacted as one would expect. CAPP spot coal prices trended downward on weak demand. NAPP and PRB spot coal prices trended upward, while ILB and Western Bituminous spot coal prices remained largely unchanged. For December 2013, spot prices for NAPP coal had improved $5/ton to $68/ton over the same period as last year. CAPP prices were down $4.57/ton to $63.58/ton; ILB $46.15/ton vs. $47.90/ton last year. Prompt prices for PRB had increased considerably to $11.50/ton from $10.45/ton. Western bituminous essentially remained the same $35.95/ton vs. $35.75/ton last year.

U.S. coal exports have slowed, but remain sizable, totaling 90 million tons year-to-date through September, compared to 98 million tons at the same time last year. Exports should eclipse 110 million tons for full year 2013. Markets for metallurgical or coking coals remain weak and exports are not expected to grow in 2014.

With a significant amount of excess capacity and lower stockpiles at utilities, PRB production has the potential to surge more than 10% (40 million tons) given a positive pricing climate and potential rebound in coal generation. The ILB will likely sustain its momentum of 5% growth or more 2014 (7 million tons). Similarly, Appalachia will see more of the same. NAPP will remain flat, while more CAP producers move more coal into export markets and abandon power generation. CAPP could see a decline of more than 5% (20 million tons).

Based on this information, Coal Age believes total U.S. coal production will grow by an additional 2.7% in 2014, which would add 27 million tons, taking total production to 1,022 million tons.

| Coal Age Readers Speak Out |

|

Continued aggressive moves by the U.S. EPA, intent upon destroying the mining and use of coal, remains our biggest challenge. Producers need to focus on cost control, maximizing the value of their coal for customers, helping the public to understand what a future without coal-fired generation looks like and fighting a delaying action in Washington in hopes that a 2017 administration will have fewer “true believers” in energy socialism.

The U.S. coal industry will be affected (either positively or negatively) by the decisions of the current government administration. If the feds continue to sit on their hands (and do virtually nothing related to the energy sector), obviously, the industry cannot make informed decisions about future capital investments and technological development. Hopefully, with the next administration change, we will have leaders in office with the backbones to make decisions based upon feedback from the real experts that truly understand the aspects of the energy industry’s production and infrastructure.

I believe that the U.S. coal industry should concentrate mostly on their exportation of product until such time that the domestic needs cycle back (which is inevitable). With the direction we are currently headed, there will be massive blackout/brownouts before the general public will demand that something different be done.

I see no way to overcome the lunacy we see in Washington as it now stands.

The EPA will affect the U.S. coal industry the most in the near future. The U.S. coal industry needs to prepare by trying to survive the Obama Administration’s remaining term. The coal industry needs to start talking to the prospective presidential candidates now so we can get a feel for who we need to vote for in 2016. All companies that depend on the coal industry need to work lean and mean for the next two to three years.

Politics, Policy And Regulation: We as an industry need to be better sales people to the public, letting them know of the value of coal in our economy (low cost electricity, jobs, supporting jobs and etc.) and that it can be transported and burned cleanly. We need to also remind them that, just as we have seen in the past, natural gas price will spike as demand rises. If we burn both coal and natural gas we can ensure our energy independence for any foreseeable future. If we can do this, Politics, Policy and Regulation will fall in line. Also, as far as export coal goes, if we do not provide it, some other country will.

More than anything, the low cost of natural gas has hurt the coal industry. Environmental regulations have just begun to have an impact but between both there is much uncertainty. The current trend appears to be to operate at the lowest cost per ton making the coal industry very competitive in the equipment and supply sector. Coal operators have to be extremely diligent with the investments they make and how they run their operations. They have to operate as safely as possible to avoid MSHA fines. Coal will be around for the foreseeable future because the only real competition is natural gas. Gas production has always been difficult to accurately predict and has been problematic in the past. If you look at history there have been up and down cycles with gas production and it seems just when everyone starts to rely on a stable supply/price the unpredictable nature of gas causes huge price fluctuations. Look for increased environmental regulations to play a role in gas production as well.

The U.S. coal producers should match dollar for dollar the Sierra Club’s “War on Coal” campaign and defend itself both here in the US and in export counties. Also the coal producers should put up a real united front and seriously fund clean coal technology and pursue a Government funding shift from solar and wind research to cleaning the CO2 out of the most abundant fuel in the US.

I believe what is the most threatening aspect of the future is the lack of education of the general public about how important coal is to their lives every day, while allowing the well-funded but extremely misleading information from the so-called greenies to form public opinion. |