|

|

By Charlotte Cox and Darren Epps, SNL Energy

For the second consecutive quarter, Powder River Basin (PRB) coal to the upper Midwest tumbled due to unreliable rail service, reviving questions about competition in the rail industry.

Rail issues in Iowa, Michigan, Minnesota, Nebraska, North Dakota, South Dakota and Wisconsin continued to plague coal-fired generators in the second quarter, forcing some to conserve coal and express concern about reliability during the upcoming winter.

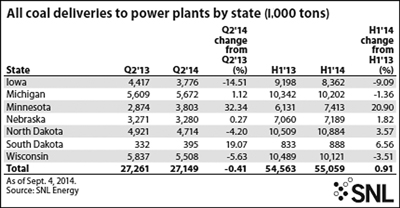

Second-quarter 2014 coal deliveries to plants in the upper Midwest from all producing regions were relatively in line with the year-ago quarter, declining less than 1%, or 111,927 tons. However, as in the first quarter of 2014, PRB coal deliveries saw a more significant hit in the region, declining nearly 2%, or 338,035 tons, compared to the second quarter of 2013. In the first half of 2014, PRB coal deliveries to the region dropped a total of 640,227 tons compared to the year-ago period despite a brutal 2013-2014 winter.

At the same time, the second quarter of 2014 saw net generation by upper Midwest units primarily fueled by coal decline 6%, or 2,515 GWh, compared to the second quarter of 2013. That drop followed a first-quarter 2014 increase of almost 7%, or 3,267 GWh, compared to the year-ago quarter. The region experienced about 3% more cooling degree days in the second quarter of 2014 compared to the year-ago quarter.

Some coal representatives and U.S. political leaders used a U.S. Surface Transportation Board (STB) hearing on rail service issues September 4 to again push for more competition in the rail industry. Coal shippers have long pleaded with the STB to allow captive shippers — customers with no other shipping options — located in terminal areas access to a competing railroad if the customer’s facility is within a 30-mile radius of an interchange point where the rails switch traffic.

In written testimony, Sen. Al Franken, D-Minn., said the rail service issue “will never be solved” until the STB acts on the issue of competition in the rail industry. “If any of these shippers had just one more option that they could consider, I believe that we wouldn’t be hearing so much about substandard service levels,” Franken said. “In a competitive market, railroads wouldn’t be able to de-prioritize certain shippers the way they can when they know that the shippers have no other options.”

Stevan Bobb, BNSF Railway Co.’s executive vice president and chief marketing officer, told the STB at the hearing that increased regulatory action would negatively impact the situation. BNSF, a unit of Warren Buffett’s Berkshire Hathaway Inc., has been the most scrutinized U.S. railroad over the past year as rail service levels have weakened.

“We need to support more rail capacity, and more rail cars onto our system will not create more capacity. It will reduce capacity and some BNSF volumes would be negatively impacted,” Bobb said. “I have heard a couple of requests to add to already congested subdivisions. This will not increase capacity. I have heard requests for geographical and commodity preferences. This would not create more capacity. A chosen commodity would move at the expense of all the others.”

What is more clear is that the rail service issues will not be completely resolved until well into 2015 or even 2016, adding continued pressure on PRB coal producers like Cloud Peak Energy, Peabody Energy and Arch Coal. A large upcoming harvest, booming crude oil hauls, rail maintenance needs and the impact from potential winter weather disruptions are among the factors that could delay a full recovery. But not all states are impacted the same. In the second quarter of 2014, Iowa had both the largest percentage and tonnage decrease in coal deliveries among upper Midwest states with a roughly 15%, or a 641,086-ton, drop compared to the second quarter of 2013. About 94% of the second-quarter decline, or 605,315 tons, was from PRB-sourced coal. The 712-MW Ottumwa, located in Wapello County, Iowa, and owned by Alliant Energy Corp. subsidiary Interstate Power & Light Co. and Berkshire Hathaway Inc. and Berkshire Hathaway Energy subsidiary MidAmerican Energy Co., reported the largest decline in PRB coal deliveries in the state during the second quarter, down 57%, or 279,409 tons, compared to the year-ago quarter.

Iowa also ranked first in terms of percentage decline in coal-fired unit net generation during the second quarter of 2014, with a drop of about 14%, or 1,011 GWh, compared to the second quarter of 2013. The 1,640-MW Walter Scott Jr. Energy Center in Pottawattamie County, Iowa, reported the largest decrease in net generation in the state, producing about 595 GWh, or 24%, less power than in the year-ago quarter. The plant is majority-owned by MidAmerican Energy.

Wisconsin had the second-largest decrease in year-over-year, second-quarter coal deliveries in 2014, with a decline of about 6%, or 328,534 tons. However, deliveries of coal to the state sourced from the PRB saw a decline of 577,196 tons, or more than 10%, compared to the year-ago quarter. Northern Appalachian coal, which saw an increase in deliveries of nearly 103%, or 259,681 tons, made up the majority of the difference.

Wisconsin also saw a decline in coal-fired unit net generation in second quarter 2014, with a roughly 10% decrease, or 930 GWh, compared to the year-ago quarter. The 1,188-MW Pleasant Prairie in Kenosha County, Wisconsin, which is owned by Wisconsin Energy Corp. subsidiary Wisconsin Electric Power Co., reported the largest decline in net generation in the state, with a 47%, or roughly 815 GWh, drop.

Meanwhile, Elm Road Station, which drove the increase in Northern Appalachian coal consumption in the state, saw a 182%, or 1,286 GWh, growth in net generation. The 1,268-MW plant is in Milwaukee County and is also majority-owned by Wisconsin Electric Power. The company is considering using more PRB coal at the Oak Creek expansion units.

David Wanner, manager of fuel services for Wisconsin Public Service Corp., said at the STB hearing that Union Pacific Corp. and Canadian National Railway Co. service issues forced the utility to curtail coal usage at the Weston plant and purchase more expensive natural gas. At the end of February, Weston’s coal inventory was down to 23% of its target.

“Unfortunately, delivered natural gas prices into parts of Wisconsin had skyrocketed,” Wanner said. “At times, the cost of natural gas in our territory was five times higher than the commonly quoted Henry Hub price, which was itself on the rise.”

WPS reinstituted coal conservation measures at Weston in mid-August. Meanwhile, Minnesota saw the largest year-over-year increase in coal deliveries by tonnage and percentage during the second quarter of 2014, with a jump of about 32%, or 929,483 tons. The entire growth was comprised of coal deliveries sourced from PRB mines, with the 2,222-MW Sherburne County, or Sherco, plant reporting the largest growth in deliveries in the state.

Owned by Xcel Energy Inc. subsidiary Northern States Power Co.-Minnesota and Southern Minnesota Municipal Power Agency, the plant received 510,811 tons, or 38%, more PRB coal in the second quarter of 2014 than the year-ago quarter. Sherco generation was impacted by a fire from 2011-2013. Correspondingly, Minnesota also saw the largest increase in coal unit net generation during the second quarter of 2014, with a 31%, or 1,315 GWh, gain year over year. Sherco contributed 889 GWh of the increase, a growth of 45% at the plant compared to the second quarter of 2013.

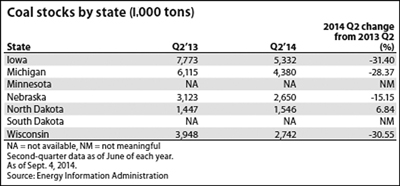

Inability to receive coal reliably can force generators to draw on their stockpiles. Of the states reporting coal stockpiles, Iowa had the largest percentage and tonnage decline year over year for June 2014, with a difference of more than 2.4 million tons, or more than 31%. Wisconsin had the second-largest percentage decline at nearly 31%, or 1.2 million tons, since June 2013.