U.S. Coal Miners Will Dig Deep to Compete

With demand from power plants remaining flat, coal operators cling to exports while dealing with federal regulators

By Steve Fiscor, editor-in-chief

Looking at the U.S. coal markets for 2013, the question is not whether it’s going to be bad or good, but how bad will it get, before it gets better. Coal operators are facing the toughest situation they have faced in a generation. For more than three years they have dealt with constant overreach from federal regulators before a glut of natural gas swamped energy markets last summer. The re-election of President Obama last fall stole what little wind remained in their sails.

Four years after the global financial crisis, the U.S. economy has not improved substantially and neither has the demand for electricity. During the election, coal operators openly ex-pressed their frustration and disbelief with the Obama administration and the Environmental Protection Agency (EPA). Outside the U.S., demand for steam coal remains healthy, but prices for metallurgical grade coal have dropped substantially.

Every January, Coal Age publishes its Annual Forecast, based on a survey conducted during late November. The informal study gives an assessment of the current market situation, as well as the state of mind among coal operators. Based on that information, and information from the leading coal companies, the Energy Information Administration (EIA) and the Edison Electric Institute, Coal Age tries to make an informed decision about future market trends. Last year’s Annual Forecast predicted a decrease by 1.2% for 2012 or 13 million tons from 1,089 million tons to 1,076 million tons. As can be seen from the Top 10 Coal-Producing States chart (See News, p. 5), total U.S. coal production fell by 6.9% in 2012, or 73 million tons, to 1,016 million tons. While this is not great news, observers should not lose sight of the fact that the U.S. still mined more than 1 billion tons of coal last year.

Overall electricity demand was flat and coal consumption declined in 2012. As a baseload fuel, coal consumption can be considered an economic indicator. The EIA expects total generation of electricity to remain largely unchanged in 2013 and to grow by 0.8% in 2014.

Overall electricity demand was flat and coal consumption declined in 2012. As a baseload fuel, coal consumption can be considered an economic indicator. The EIA expects total generation of electricity to remain largely unchanged in 2013 and to grow by 0.8% in 2014.

Regulatory uncertainty and low natural gas prices kept utility fuel buyers thinking short term. At one point during May 2012, coal and natural gas consumption reached parity for the first time. Even though utilities burned through considerable coal stockpiles in late summer and early fall, spot coal prices fell to their lowest levels in at least four years. The EIA believes that an increase in natural gas prices in 2013 will lead to increase coal burn. With coal stocks remaining high, coal production is still expected to decrease next year.

In addition to supply and demand fundamentals, the survey asked coal operators about their feelings, the amount of money they plan to spend this year, and how they intend to spend it. The survey also asked them to rank issues affecting the industry. A similar open-ended question, designed to identify possible overlooked issues, elicited an overwhelmingly similar set of responses that singled out the Obama administration, the EPA and other federal agencies as trying to drive the coal industry out of business. Last year, the respondents expressed negativity, anger and frustration. This year, the responses were measurably worse, peppered with expletives.

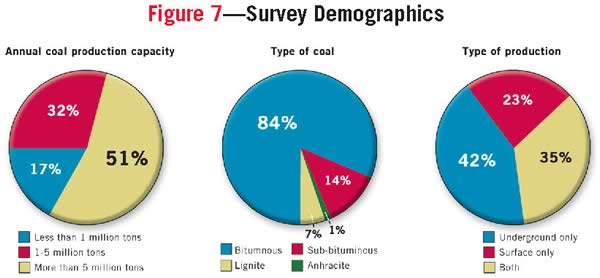

Mines Will Cut Costs to Survive Until the Climate Changes

Coal Age contacted 662 readers and received 97 completed surveys. The demographics largely resemble the U.S. coal industry. The majority of them (84%) produced bituminous coal. Subbituminous, lignite and anthracite accounted for 14%, 7% and 1% respectively. As far as production capacity, most of the respondents represented large mine operators (more than 5 million tons, 51%), followed by medium (1-5 million tons, 32%) and small (less than 1 million tons, 17%); 42% described themselves as underground coal operators exclusively, while 23% said they only operated surface mines. The remainder (35%) said they worked for a company that mined coal using both surface and underground techniques. Similar to years past, most of the respondents said their coal went to electric utilities (68%). The remainder said their coal was destined for steel mills (20%) or industrial boilers (12%). Steam coal is the overwhelming use for the majority of U.S. coal production.

Never before in the history of the Forecast Survey have so many respondents expressed a pessimistic outlook. A whopping 73% of the respondents are looking at 2013 with pessimism. Only 10% of the respondents were optimistic.

Of the executives surveyed, 48% thought coal production would decrease in 2013, while 26% felt production would increase and 27% said production would remain the same. That is a complete reversal from the typical responses received over the course of the last 10 years. Last year, for example, 48% of the respondents thought 2012 coal production would increase and 12% thought it would decrease—what a difference a year makes. Looking ahead to 2014, 42% of the respondents see the market staying the same and the rest are evenly divided (28% vs. 30%) as to whether it will increase or decrease.

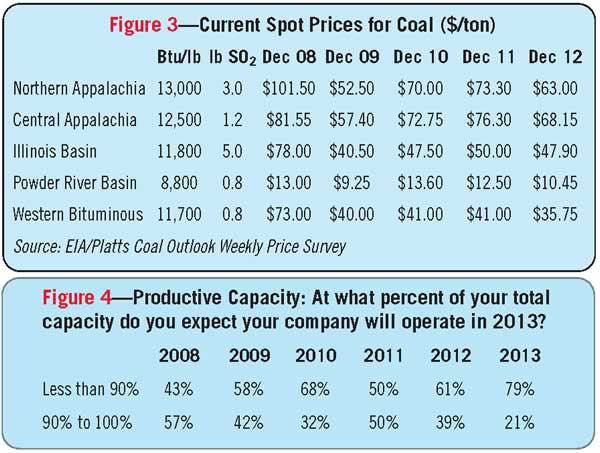

The question regarding productive capacity generated a similar pessimistic response (See Figure 4). A total of 79% of the respondents thought their mines would run at less than 90%. Again, that figure has not been that high in more than 10 years if ever. So, it’s safe to say the coal industry will be entering a period of over capacity. How long that lasts depends on a number of different variables.

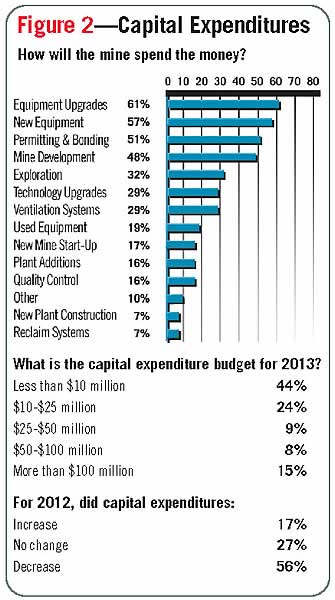

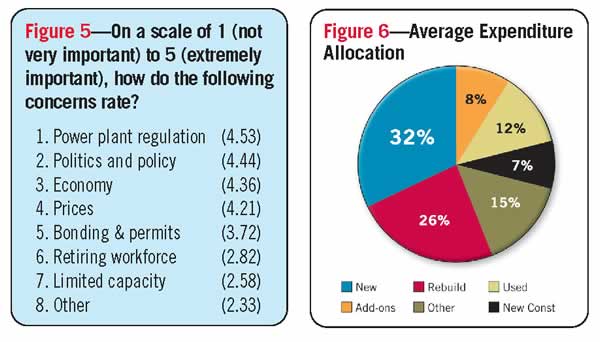

Coal mining is a capital intensive business. Only 17% reported a capital budget increase for 2012, while 56% said it had decreased. When asked how they would spend the money, they said equipment upgrades (61%), new equipment (74%), mine development (57%), permitting (51%) and mine development (48%). Equipment upgrades have taken a priority over new equipment for the second consecutive year. When asked how their money would be allocated on a percentage basis, the respondents said 32% of their money would be spent on new equipment and 26% would be spent on equipment rebuilds (See Figure 6).

When asked about their capital budgets, 44% of the respondents reported they would spend less than $10 million this year. A total of 15% said they would spend more than $100 million; 24%, $10-$25 million; 9%, $25-$50 million; and 8%, $50-$100 million. This year 68% will spend $25 million or less. Last year that figure was 47%. Obviously, a lot of major purchases and investment plans for various projects have been tabled.

Coal operators expressed a lot of frustration in the survey. When asked: What will affect the U.S. coal industry the most and how should it prepare? Nearly half of the respondents (47%) cited EPA overreach (or the EPA War on Coal) and another 12% referred to the Obama administration. A significant group (16%) said low natural gas prices. Very few had constructive ideas on how to prepare. A common answer was: Pray. A sampling of several of the responses, which were fit for publication, are offered anonymously on page 24.

When asked about what specific issues will affect the coal industry the most in 2013, the obvious, overwhelming response was power plant regulation. Politics and policy and the economy remained more of concern than prices. Reading between the lines, the miners are saying that prices and the economy do not matter if they can’t operate a mine or their customers are not allowed to burn coal. Limited production capacity was the least of their concerns.

Domestic Market Softens, While Exports Improve

As mentioned previously, total U.S. coal production for 2012 decreased of 6.9% to 1,016 million tons from 1,089 million, a 73-million-ton decline. Coal production for the top three states, Wyoming, West Virginia and Kentucky, fell by 8.7%, 8.2% and 13.2% respectively. Wyoming dropped below 400 million tons for the first time in several years and Kentucky fell below 100 million tons for the first time in decades. Illinois and Colorado, on the other hand, posted some respectable positive numbers, 24.4% and 10.3% respectively.

The American economy is powered by electricity and coal demand will increase when that manufacturing base begins to grow again. The EIA estimates coal consumption in the electric power sector totaled 829 million tons in 2012, the lowest amount since 1992. Lower natural gas prices led to a significant increase in the share of natural gas-fired generation. The EIA expects the coal share of total electricity generation to rise from 37.6% in 2012 to 39% in 2013 and 39.6% in 2014, as natural gas prices rise relative to coal prices. Higher natural gas prices, coupled with slightly higher electricity demand, will lead to an increase in coal-fired generation.

Natural gas prices currently stand at $3.494/mmBtu, $0.786/mmBtu higher than one year ago. Natural gas prices have declined steadily from $5.599/mmBtu in January 2010 to $4.499/mmBtu in January 2011, then to $2.708/mmBtu in January 2012, before bottoming out in April 2012 at $2.048/mmBtu. Delivered steam coal prices averaged $2.39/mmBtu in 2011, a 6% increase from 2010. Seeing natural gas prices move higher brings a sense of relief to the coal market, but gas producers could easily flood the market again. Unlike years past, natural gas is expected to remain abundant.

Coal stocks at electric utilities remain high, in the 180 million ton to 190 million ton range, which dampens coal prices for prompt deliveries. During 2012, spot prices for coal dropped by double digit percentages for all regions except Illinois Basin. With the exception of Western bituminous, they have not dropped as low as 2009. As an example (See Figure 3), December 2012 spot prices for Northern Appalachian (NAPP) coal decline to $63/ton from $73.30/ton. CAPP prices were $68.15/ton compared to $76.30/ton last year; Illinois Basin $47.90/ton vs. $50/ton last year. Prompt prices for PRB had dropped considerably to $10.45/ton from $12.50/ton. Western bituminous decreased to $35.75/ton from $41/ton.

U.S. coal exports reached a record 124 million tons in 2012. While coal demand should remain brisk abroad, prices for met coal are not expected to increase substantially, barring any supply disruptions. Many of the U.S. ports are handling coal at maximum capacity, which would also preclude any surge in exports.

Based on this information, Coal Age believes total U.S. coal production will decline by an additional 4% in 2013, which would be 41 million tons, dropping total production to 975 million tons. That would be the first time U.S. coal production has fallen below the 1-billion-ton threshold since 1993. While this is certainly a negative trend, those who follow coal markets should bear in mind that the U.S. will still mine nearly 1 billion tons of coal.

Coal Age Readers Speak Out

Dig in and prepare for the next 4 years

Ultimately, Congress can control the reach of the EPA and public opinion affects Congressional elections. The coal industry really needs to take its case to the public.

The industry must continue to look for ways to become more and more efficient so that our costs can stay low as compared to natural gas, and renewables.

The EPA and its undeniable war on coal are big concerns. Their overzealous and eagerly pursued attempt to remove coal as a power source is sadly popular among the public that blindly follows the fear mongering of the anti-coal campaign. People actually believe that a few windmills will supply us with the power we need. The coal industry needs to counter this campaign with its own offense.

Government Regulations (MSHA, EPA, etc.) are strangling this industry. If we continue down this path without concern or respect for the economic consequences or the awareness that there must be an alternative power generation source to replace the lost energy that coal generates, the economy of this country is at great risk of collapse.

The public needs to be enlightened as to the effect the administration’s assault on the coal industry and the use of coal will ultimately have on people’s power bill at the house. They need to be told that, once the symptoms appear, it’s too late to cure the disease.

The industry must clean up its act on safety and environmental problems.

The supply of low cost natural gas will have a profound and lasting effect on the coal producers.

The Obama administration’s anti-coal stance and the EPA’s ever growing regulations are and will continue to make it difficult for the coal industry to do business.

I’m not sure how to prepare other than downsize the industry to match demand. It’s sickening.

The Obama administration’s determination to regulate [the coal industry] out of existence. The coal industry should prepare by trying to keep the public informed on the importance and reliability of coal and how it helps our economy and to put pressure on politicians to challenge the EPA every step of the way.

The 2012 US presidential election dealt a severe blow to the coal industry. The industry must fight back and not just accept that which is handed to it. At the same time, it must strive diligently to reduce its cost structure such that it is more competitive than it has been.

Natural gas has eroded the coal industry’s base but the NG price is not sustainable. The coal industry must be ready to reclaim its market share as the gas price rises. Again, cost control is a necessity.

The US coal industry needs to be honest with itself about changes in the market place as well as changes in technology. Owners of coal mines need to be efficient, safe, and realistic. There are some companies that have started to transform themselves into energy companies, diversifying so that they don’t have too much risk with only coal operations. This seems right. There will be more consolidation. The market is going to right size itself. Those firms that are not safe, not efficient and not cost effective should be eliminated from the industry.

The problem is a lack of creativity. We do no research, we fail to change our mining and processing methods, and we make no technological advances. The Australian model should be considered. Our industry should work as one to fund and direct research and development of means by which we can become more efficient, safer and less damaging to the environment. The world is changing but we continue to mine, process and utilize coal as we have for the last 40 years.

Coal is apparently the power source of last resort with a majority of U.S. citizens. The coal industry should prepare for contraction of domestic sales to match coal-fired generation being less than 30% of the source for electrical generation over the next decade.