A production surplus in 2013 has hurt the Ukrainian coal industry — the country’s stocks as of the beginning of September amounted to 6 million metric tons (mt), which was a record. This situation has resulted in a price collapse and the government was forced to initiate a series of steps to protect the industry. In particular, Ukraine has ordered some state companies to reduce the level of production, and in addition, has even decided to temporary close about 17% of all mines in the country. Also, the government proposed to ban any import of coke, but the parliament rejected this offer and introduced a very limited quota on the import of coke during 2013.

According to industry experts, the main problem of the Ukraine coal market is the absence of an Energy Balance Plan — the government has not yet calculated how much coal Ukraine will consume in 2013 and so they do not know what to do with the surplus. Also a major problem is illegal mining, which according to some estimates, amounts to 9 million mt of coal annually.

At the same time, the country’s leadership believes the industry’s problems are temporary, and in the coming years, Ukraine will be able to increase coal production to record levels, which will significantly reduce the country’s dependence on imports of natural gas from Russia. This goal is one of the top priorities of economic development for Ukraine.

Production and Profits Fall

According to the data of the Ministry of Energy and Mining, Ukraine is the fourth largest coal producer in Europe after Russia, Germany and Poland. The Ukrainian coal industry is believed to have 4% of world coal reserves, or 33.9 billion mt of proven reserves. This is enough to maintain the level of coal mining for 2012 in the country for about 400 years.

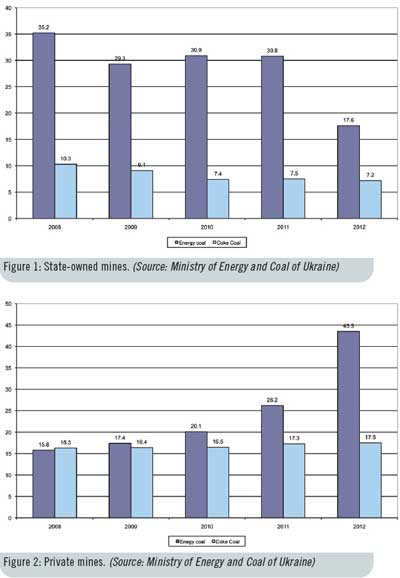

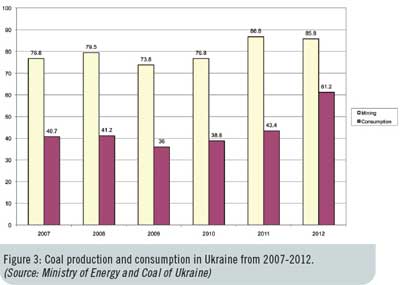

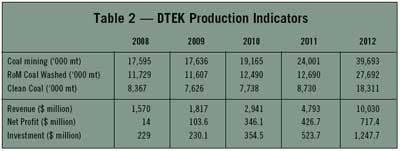

The level of mining in the Ukraine during recent years remains stable with a significant jump in 2012 (Figure 3). In addition, the government is steadily selling state mines to private companies, which resulted in the level of mining in the state-owned mines to decrease almost every year, both in energy and coke coal, while the level of mining in the private mines is rising, which is reflected in the data of the Ministry of Energy and Coal (Figure 1 and 2).

However, during the first half of the year, Ukraine’s level of coal mining decreased by 5.3 % on year-to-year comparison to 40.5 million mt, with state-owned mines reporting the most remarkable drop — 7.8 % on year-to-year comparison — to 11.1 million mt.

However, during the first half of the year, Ukraine’s level of coal mining decreased by 5.3 % on year-to-year comparison to 40.5 million mt, with state-owned mines reporting the most remarkable drop — 7.8 % on year-to-year comparison — to 11.1 million mt.

In monetary terms, the losses in the industry are even more significant. During the first six months of this year, the state-owned mines produced coal for $561 million, which is 16.1% less than the same period of 2012. The reason for this difference in production lies with the fall in the price of coal.

According to the State Statistic Service of Ukraine, in January-June 2013, the average price of commercial coal products in the domestic market amounted to $61 per mt. In comparison with January-June 2012, the average price fell by 17.8% from $72 per mt. At the same time, experts say the price continues to decline.

Another serious problem for Ukraine coal miners is that the actual cost of production averages $169.70 per mt. Compared to January-June 2012, this figure rose by 9.8%. Finding themselves in very tough economic conditions, the state-owned mines applied to the government requesting additional financial support.

The Minister of Energy and Coal of Ukraine Edward Stavitskiy said the state budget for 2013 provided $1.17 billion of support to the state-owned mines. As of June, $678 million had already been spent. Because of this, the ministry initiated an increase in budgetary support to the coal industry in 2013, claiming that without such support, a large number of mines may go bankrupt.

In response, the state parliament has allocated an additional $775 million from the state budget to help the coal mines keep a sufficient level of profitability and stay afloat. However, experts say that because prices continue to fall, even this increase in funding may not be enough to get the industry under control.

A Strategy for Coal Industry Development

The current problems of the industry have put the country’s ability to reach its energy self-sufficiency goals in doubt. The country adopted a strategy for coal industry development, the Energy Strategy of Ukraine, until 2030. The strategy provides the increase in coal mining in the country by 30 million mt per year (mtpy) in coming years, which should be reached due to the large investments in operations that will amount to $6.06 billion during the coming 17 years.

With this money, the Ministry of Energy and Coal expects to put into operation a number of state-owned mines where construction has been launched in recent years. The total capacity of the new mines that should be launched in the next three years is expected to be about 3 million mtpy.

The strategy also provides for the closure of mines, which will not be amusing for private investors. Mines where reserves will be exhausted should also be closed until 2030. The program provides for the liberalization of the coal market and almost complete sale of all state-owned mines to the private companies. In coming years, the ministry intends to create a system of coal trading on electronic exchanges and a system of pricing based on the calorific value of coal.

According to the strategy, one of the most promising issues in the industry, which should attract a lot of attention of the government, will be the integrated use of coal deposits, with the use of coal bed methane formations.

According to the strategy, one of the most promising issues in the industry, which should attract a lot of attention of the government, will be the integrated use of coal deposits, with the use of coal bed methane formations.

With all of the steps mentioned above, as well as the other steps provided by the program that are implemented, and even with partial closure of unprofitable mines, the level of coal mining in Ukraine should rise by 50% compared with the level of coal mining in 2010. This will enable the industry to let the country significantly decrease the dependency of the large number of industries on natural gas, which is extremely important for the economy in the context of the non-steady trade relationships with Russia — the main supplier of natural gas.

The strategy provides that coal production will reach 115 million mt by 2030, with 75 million mt accounted for energy coal. At the same time, the government expects to bring the industry to the “break-even point” and stop any subsidizing of the mines. This is a crucial task as the amount of funding of the coal industry over the past 10 years has increased almost four-fold, and in 2012, it accounted for 2.2% of total government revenue in Ukraine, while in 2013, this figure is projected to rise to 3%.

The importance of increasing the level of coal mining has been expressed by President Viktor Yanukovich. “Ukraine plans to annually produce 105 million mt of coal for the full replacement of natural gas in the energy sector,” he said. “In particular, the government plans to fully replace natural gas with coal in metallurgy as well as some other sectors of the economy. If in 2009 we produced only about 68-69 million mt of coal, this year we will have production of 86-87 million mt. As the result, in the energy sector, we already are not using gas.”

Government Struggles with Oversupply

Government Struggles with Oversupply

When the government initiated a series of steps to fight against the oversupply in the domestic market, one of the most controversial measures was the decision to close the number of the completely and partially state-owned mines.

According to Chairman of the Independent Trade Union of Miners Michael Volynets, so far the government has decided to close 35 mines in the Ukraine during 2013. Currently in Ukraine, there are about 200 mines operating, so in fact, the authorities plan to temporary close about 17% of all coal mining enterprises.

“There is a list of 35 mines on the dry conservation and closing,” Volynets said. “These mines are on two-thirds or one-third public property, and have also some part of private property. Also, this list includes some mines of Metinvest, which produces coking coal. If we make an emphasis on the development of the mining industry, if we focus on metallurgy, then it is unclear why Ukraine closes enterprises that mine valuable types of coking coal.”

Volynets also added that the coal industry of Ukraine is on the verge of a major crisis because of the illegal mining that is seriously contributing to oversupply.

“The excess of coal in the domestic market can be explained by the sharp increase in its production in the illegal mines, the so-called ‘makeshift coalmines,’” he said. “This is confirmed by data obtained from the Ministry of Energy. Last year, a supply of thermal coal in the country’s market amounted to 55.3 million mt (61.1 million mt of production plus import of 27,000 mt and exports of 5.8 million mt). The carry-over has increased from 4 million mt to 5.7 million mt in the same period, while coal consumption totaled 61.2 million mt. The ministry failed to explain where the additional 4.2 million mt of the market value of $363 million came from.”

A significant part of illegally mined coal is being exported to Bulgaria, so according to the approximate estimations, the total volume of illegal mining could be about 6-9 million mt.

A significant part of illegally mined coal is being exported to Bulgaria, so according to the approximate estimations, the total volume of illegal mining could be about 6-9 million mt.

Chairman of the Trade Union of the Coal Industry of Ukraine Viktor Turmanov said the union has appealed to the prime minister to deal with illegal mining. “We are talking in the first place about type A coal, about 5.3 million mt of which were sold to the state power plants and about 900 mt were going for export,” Turmanov said. “However, even with the serious criminal liability entered by the authorities for illegal coal mining, the fight against it still sees no success.”

Volynets reported that traditionally coal from makeshift coal mines is one-third cheaper than the coal from the legal mines. “These mines do not pay taxes; they do not care about safety of workers or their social protection. They are using almost slave labor or child labor and they are the shame of Ukraine,” Volynets said.

Alexander Chmirenko, general director of energy producing company Centrenergo, explained that during the purchasing of coal in the market, no one finds out where the coal has been mined. “We should comply with the law on public procurements, which provides that the coal should be bought at the tender. Whoever can come to us and if he offers the best conditions then he wins and we cannot check where his coal came from,” he said.

Another controversial measure the government has taken on in the fight against oversupply was introducing a quote on the import of coking coal in the amount of 10.2 million mt for the country and 210,000 mt on coke, which was introduced exclusively for one enterprise — ArcelorMittal. The heads of Russia and some European Union countries already say this quote is a contradiction to World Trade Organization rules and some bilateral agreements, and asked Ukraine to cancel it, threading to implement some trade restrictions in response. Ukraine authorities are still considering it.

DTEK Plans Large-scale Production Upgrade

DTEK Plans Large-scale Production Upgrade

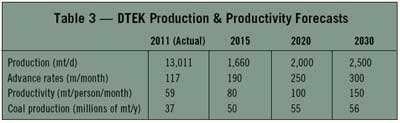

The future of the coal industry in the Ukraine is closely tied to the group of companies, DTEK, which accounted for almost 50% of total coal mining in the country and recently adopted a complex development program. The strategy of development of DTEK is divided into three stages.

The first stage (2012-2015) provides the consolidation of all coal mines to the system of a single management structure and standardization of business processes. According to the representatives of the company, DTEK intends to spread out the best practices of managing operational, investments and budgeting processes that have been developed during the recent years at DTEK mine Komsomolets Donbassa and DTEK Pavlohradvuhillia to the enterprises that have recently arrived in the structure of DTEK — Dobropillyavuhillya, Rovenkianthracite and Sverdlovanthracite. According to the head of the coal mining department of DTEK, Andrey Smirnov, the changing of the management scheme will increase the efficiency of production as well as key performance indicators. At this stage, the company plans to significantly improve the technology of coal beneficiation, infrastructure development and implement various operational improvements.

In the second stage (2016-2020), the management of the company intends to focus on increasing the level of mining. DTEK plans to carry out major construction to maintain the capacity and the development of mines, to apply new efficient technologies, as well as to “relieve bottlenecks.” In particular, the strategy provides technical re-equipment of the mining transport — the introduction of diesel monorails, main conveyor belt of new generation and other modern technology.

In the second stage (2016-2020), the management of the company intends to focus on increasing the level of mining. DTEK plans to carry out major construction to maintain the capacity and the development of mines, to apply new efficient technologies, as well as to “relieve bottlenecks.” In particular, the strategy provides technical re-equipment of the mining transport — the introduction of diesel monorails, main conveyor belt of new generation and other modern technology.

The technology for sewage treatment plants will be upgraded through the purchasing and installation of modern mechanized shied props with the system of electrohydraulic control of production, which will be supplied by the companies Ostroj, BMW (Czech Republic), Fazos (Poland), Cat (Germany) and Sany (China). Also, the strategy provides for the purchasing of high-efficiency cutter loaders from Eickhoff (Germany), T-Machinery (Czech Republic) and Mining Machines (Ukraine), as well as plow systems from Ostroj (Czech Republic) and Cat (Germany). Modernization of the equipment of tunnel works will be carried out with the use of power-to-tunneling machines from Joy Dosco (England), DH (Germany) and Sany (China).

Improving conditions of air ventilation in mines will also take place at this stage and it will involve the construction of downcast ventilating shaft and boreholes, construction and modernization of vacuum pumping systems, and installation of new systems of draining out gases.

The most important target of the second stage of strategy implementation, according to Smirnov, will be reducing production costs with the widespread introduction of so-called lean technologies. “They are just beginning to spread in the world of coal mining, and DTEK pays a lot of attention to this issue,” said Smirnov.

The third stage (2021-2030) also will focus on innovation and, in particular, the introduction of new technologies that require the minimal presence of people in the long face and the use of transport systems of the new generation (diesel and electric railcars, curving conveyors, etc.). In addition, this stage of strategy implementation provides for the installation of automatic control systems with remote control, automatic control of security settings, mining, manufacturing and engineering processes.

“Our company is committed to intensifying production through the use of modern scientific technologies, realizing that this is the only approach that will ensure the good future of the company in competition with other producers of coal production,” said Smirnov.

At the third stage, the company plans to seriously decrease the number of employers.

If all of these innovations are successfully implemented, the company will increase the level of mining to 56 million mt until 2013, at the same time improving all the main production indicators, which are reflected in Table 3.

Based in Moscow, Vladislav Vorotnikov is a freelance writer who specializes in heavy-industry trade reporting. He contributes regularly to Coal Age and can be reached at: vorotnikov.vlsl@gmail.com.