By Dave Gambrel

| Construction begins on the new Casky Inspection Yard in Kentucky for ILB coal trains. (Source: CSX) |

In August 2014, STB Chairman Daniel Elliott wrote to seven Class I and two short line railroads requesting an assessment of their ability to meet traditional “fall peak” service demands. This review of their responses focuses on the two railroads that comprise the majority of U.S. eastern coal mine originations, CSX and Norfolk Southern (NS). While Canadian National (CN) does originate coal at a few Illinois mines, its response did not deal with coal.

The background on which the two railroads replied is set against a sharply reduced coal production sub-region, Central Appalachia (CAPP). While coal production in both Northern (145 million tons per year) and Southern Appalachia (20 million tpy) is expected to remain relatively unchanged, CAPP production has been hammered by the EPA since Obama’s first election. During the mid-1990s CAPP was producing between 250 million tpy and 290 million tpy. In 2008, it began to slide significantly from 240 million tpy to 100 million tpy, and has shown no inclination to return from that level.

Last October, the Rail Energy Transpor-tation Advisory Committee (RETAC) published Energy Outlook 2014: Coal Supply and Demand Projections Through 2040, its annual report. A key feature of the RETAC report is its projection of coal prices by region, divided into Appalachia, Interior and West. With the exception of PRB coal handed off by BNSF to NS in Memphis, Appalachian coal is still the source of most CSX and NS coal originations, and is the coal expected to rise most sharply in price over the next 25 years, a reflection of its mining challenges.

CSX Invests in Locomotives and Rolling Stock

CSX Invests in Locomotives and Rolling Stock

CSX is expanding its locomotive fleet by bringing on leased units and accelerating locomotive rebuilds and heavy repairs. “Much of that work is being done by CSX mechanical employees, working under new labor agreements that enhance productivity in exchange for improved wages and job security,” said CSX CEO Mike Ward. “The company has already increased its locomotive count by 375 units (about 10%) over this time last year. The company has also ordered 300 new engines that will be delivered in 2015 and 2016. Additional locomotives will support system-wide on-time originations and arrivals, aid in network fluidity and recoverability, and support continued growth.”

Other CSX rolling stock is also being increased to support sustainable growth. During the first quarter of 2014, CSX pulled approximately 5,000 rail cars out of storage to accommodate growth, with an emphasis on coal, grain and metals. “In addition to aggressive car purchases over the past three years, CSX is now undertaking the largest car rebuild program in its history, including 470 stainless steel Coke Express cars and 1,400 stainless steel triple hoppers that have been refurbished and are now hauling freight,” Ward said. “In addition to the rebuilt equipment already in over-the-road service, another 1,100 triple hoppers are expected to be complete by year-end 2014. Work will soon begin on approximately 3,000 coal gondolas that will be converted from traditional carbon steel into hybrid stainless steel/aluminum cars and placed into service in 2015.”

While capacity improvements will be heavily concentrated in the northern region of CSX service, CSX is investing in a new facility in Kentucky that will support the grain harvest and increases in Illinois Basin (ILB) coal shipments. ILB coal facilities directly served by CSX include Cardinal 9 (Alliance), Carlisle (Hallador), Cimarron (Alliance), Dotiki (Alliance), Gibson Coal (Alliance), Hazleton (Hallador) and Oaktown (Hallador). Seven facilities not located on CSX are also supported: Bear Run (Peabody), Calvert City Terminal (Southern Coal Handling Services), Epworth (Alliance), Galatia (Murray), Dial/Pond Creek (Foresight), Sugar Camp (Foresight) and White Oak.

While capacity improvements will be heavily concentrated in the northern region of CSX service, CSX is investing in a new facility in Kentucky that will support the grain harvest and increases in Illinois Basin (ILB) coal shipments. ILB coal facilities directly served by CSX include Cardinal 9 (Alliance), Carlisle (Hallador), Cimarron (Alliance), Dotiki (Alliance), Gibson Coal (Alliance), Hazleton (Hallador) and Oaktown (Hallador). Seven facilities not located on CSX are also supported: Bear Run (Peabody), Calvert City Terminal (Southern Coal Handling Services), Epworth (Alliance), Galatia (Murray), Dial/Pond Creek (Foresight), Sugar Camp (Foresight) and White Oak.

The new Casky Inspection Yard in Hopkinsville, Kentucky, will be used exclusively for coal train inspections. The yard is designed to enable the inspection of cars without disassembling unit trains. Trains are currently divided into three separate pieces and moved onto three different inspection tracks in Madisonville, Kentucky. The new yard will enable empty coal trains to enter the yard, undergo inspection, receive fuel and other services and continue on to the coal mines for loading. The objective is to dramatically reduce dwell time, increase capacity and greatly improve operating efficiency of the ILB trains. The trains will remain as a single long unbroken car string rather than the multiple segments required for the existing operations today.

The export coal market continues to show volatility as global supply outpaces demand and pressures global market pricing for both steam and metallurgical coals. Expectations for CSX export coal movements in 2014 remain in the mid-30 million tpy range. Following three years of transition in the domestic coal market, the extreme winter conditions forced utilities to draw down their coal inventories, revitalizing the domestic coal market in the first half of the year. Domestic shipments increased 7% in the first quarter and 15% in the second quarter. CSX expects growth to continue in the double-digit range as it continues to make up for coal shortages caused by the blizzards of 2014-2015.

The export coal market continues to show volatility as global supply outpaces demand and pressures global market pricing for both steam and metallurgical coals. Expectations for CSX export coal movements in 2014 remain in the mid-30 million tpy range. Following three years of transition in the domestic coal market, the extreme winter conditions forced utilities to draw down their coal inventories, revitalizing the domestic coal market in the first half of the year. Domestic shipments increased 7% in the first quarter and 15% in the second quarter. CSX expects growth to continue in the double-digit range as it continues to make up for coal shortages caused by the blizzards of 2014-2015.

CSX’s Coal Origin Directory (updated in February 2015) sheds light on how much the railroad might be affected by mine closures. It does not reveal how many mines are closed, but it does show that of the rail loading facilities currently served 115 are in CAPP, 24 are in Northern Appalachia (NAPP), and 10 are in Southern Appalachia; 16 are in the ILB. Some of the listed loading facilities serve more than one mine (and are often known by more than one name). CSX does not originate any Western coal, but does receive coal from railroads serving western mines.

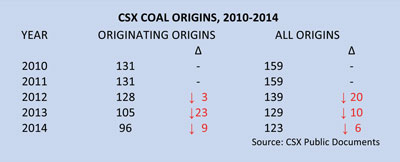

Rather than attempting to define how many mines and load-outs have been shut down, CSX has detailed the number they actually shipped from. Some mines went to a warm idle condition rather than a full cold shutdown, so the year-over-year change does not actually state how many mines shut down. The count for origins moving coal on CSX is currently as follows.

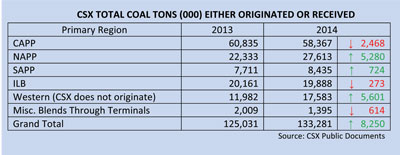

In spite of the number of origination dropouts that occurred in the 2012-2013 period, CSX still shipped 8.3 million tons more in 2014 than it had in 2013. CAPP originations dropped about 2.5 million tons (4%), but surprising gains were seen in NAPP originations of 5.3 million tons (24%) and Western coal receipts of 5.6 million tons (47%). The Western tonnage was all for domestic utilities and the vast majority was Powder River Basin (PRB) sourced. CSX handled about a dozen Colorado-sourced trains in 2013 and only a couple in 2014. All the rest of the volume was sourced from the PRB. These trains were interchanged with the two big western Class I railroads through either Chicago or East St. Louis.

Curtis Bay Terminal, which is sourced primarily from NAPP mines in CSX’s former B&O District, has continued to ship more than 7 million tpy since 2011. NAPP production changes are a secondary, almost non-existent issue impacting 2013 and 2014 volume changes as compared to reductions in international demand and over-supply of coal from multiple foreign countries. Prior to 2011 the terminal, which has undergone extensive upgrading, never reached 5 million tpy.

ILB Origins on NS Grow

With track and facilities across 20,000 miles and 22 states, Norfolk Southern (NS) operates a capital-intensive business. In 2015, they plan to invest a record $2.4 billion to ensure its rail system is in top condition to serve customers and communities. “Our own internal projections for 2014 generally predicted flat growth, with increases in intermodal and crude oil shipments partially offsetting expected decreases in coal,” said NS Chairman Wick Moorman. “For the second quarter of 2014, traffic was up 8% over the second quarter of [2013], which includes double-digit increases in intermodal along with gains in both merchandise and coal traffic. To put the volume growth in perspective, our weekly volumes averaged about 153,000 loads in the second quarter of [2014] compared to 141,000 [in 2013]. In fact, we only saw volumes exceed 150,000 loads in two weeks of all of 2013.

|

| Norfolk Southern terminal dwell. (Source: AAR Performance Measures) |

“Overall coal volume increased 3% in the second quarter of 2014 over the second quarter of [2013],” Moorman said. “Utility coal shipments were expected to be flat throughout the remainder of the year due to mild summer weather and falling natural gas prices. Coal volumes were expected to be tempered by weaker export metallurgical and thermal coal market conditions along with lower domestic metallurgical coal shipments. Of course there was no way of knowing how hard the entire northeastern United States would be hit by blizzards beginning in mid-January, 2015, and how that might affect all rail traffic for many weeks.”

In a September presentation to investors and financial analysts NS Vice President-Coal David Lawson said a key driver of the volume change since 2010 had been plant retirements due to environmental regulations. “Since 2010 these retirements have impacted our utility volume by 12 million tons to date,” Lawson said. “We believe that the remaining impact to be approximately 2 million tons by the end of 2015. The good news is the remaining utility fleet represents a fleet of larger, newer and fully controlled older scrubbed plants that meet the stringent 2015 EPA requirements.” Ironically, ILB coal originations on NS rose sharply during this same period of time.

The NS budget for 2014 was approximately $2.2 billion, which included capital roadway improvements of $910 million, $300 million to acquire new locomotives and rebuild/upgrade existing units, $220 million for PTC (positive train control) implementation, and $210 million for investments in facilities and terminals. In addition to infrastructure improvements NS continues to invest in innovation initiatives to improve service for its customers, such as the Unified Train Control System (UTCS). It acts as a traffic control system similar to aircraft traffic control, using sophisticated algorithms to formulate a comprehensive movement plan that minimizes real-time traffic congestion and delays, and maximizes schedule adherence from an overall system perspective.

As is the case with most railroads, the primary challenge for NS is maximizing the velocity of its rolling stock and locomotives; the number of locomotives is not an issue. NS entered the third quarter of 2014 with 220 more locomotives available for transportation than in the third quarter of 2013. They took delivery of 25 new locomotives in the first quarter and expected to receive 50 more beginning in October. They also expect to acquire and rebuild used locomotives as opportunities present.

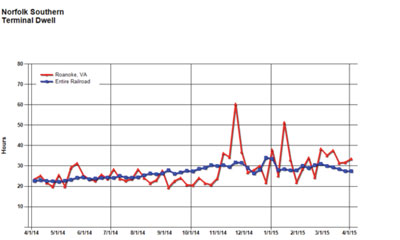

Because of its centralized location with respect to the Virginia coal fields, the measurement of dwell time at Roanoke, Virginia, is a good measure of the efficiency of NS coal trains. The entire railroad had been experiencing a steady rise in dwell time since the winter of 2013-2014, but the coal unit remained at a very steady 24-hour level until mid-November 2014. Dwell times at Roanoke jumped to 60 hours in early December, and have since “settled” at a new level of about 30 hours — something to work on.

Dave Gambrel consults and writes about coal terminals and about major modes of coal transportation: rail, barge, and ocean. He has also written articles in iron ore transportation by sea, and has contributed to annual report production for the coal industry. He may be reached at bunkgambrel@earthlink.net.