Coal accounts for 27% of hydrogen demand (IEA 2019).

Packaged with carbon sequestration and utilization, coal-derived hydrogen could help meet the world’s emissions targets

by greg kelsall, principal associate, iea clean coal centre

Editor’s note: In the effort to control emissions, hydrogen has emerged as a promising carbon-free energy carrier. Few realize that much of the world’s hydrogen is derived from fossil fuels. Transitioning to hydrogen as an energy carrier would be a good development for coal. When coupled with carbon capture utilization and sequestration (CCUS), the carbon intensity of coal-derived hydrogen is actually lower than the green hydrogen generated by electrolysis and grid electricity. The IEA Clean Coal Centre in the U.K. recently produced a webinar on Hydrogen from Coal and what follows is an article based on that discussion. The webinar and all of slides are available at https://www.iea-coal.org.

Hydrogen (H2) is gaseous at atmospheric pressure and temperature and is most commonly found in the form of water, but also in hydrocarbons such as methane, gasoline and coal. It’s non-corrosive although it can cause embrittlement of some metals and alloys, which has potential implications for material choice in pipelines and system components.

Gaseous H2 is 14 times lighter than air. This means that if released in an open environment, hydrogen will typically rise and disperse rapidly, representing a safety advantage. If released in a confined space, however, H2 could accumulate and reach a flammable concentration.

Hydrogen has a high energy content of 120 megaJoules per kilogram (MJ/kg) on a mass basis, whereas on a volumetric basis, the energy content at 10.8 MJ per cubic meter (MJ/m3) is relatively low. This is a particular challenge for storage. To store sufficient quantities of hydrogen gas, it is typically compressed and stored at high pressures. Alternatively, hydrogen containing compounds, which are liquid at temperatures and pressures relatively close to ambient conditions, such as ammonia and methanol, can be used as a means of transporting and storing hydrogen.

A color classification system has been developed for hydrogen. H2 produced by steam methane reforming (SMR) of natural gas or by gasification of coal is referred to as grey hydrogen. CO2 emissions for this type of hydrogen are relatively high, particularly with coal. Blue hydrogen is grey hydrogen that includes carbon abatement, such as CCUS. Green hydrogen is produced through the electrolysis of water, similar to charging a battery on a massive scale.

Interest has grown in the potential of hydrogen to become a clean energy carrier in the move toward limiting global temperature rise. The term energy carrier means that its potential role has some similarities with electricity. A key difference between hydrogen and electricity is that hydrogen is a chemical energy carrier, which means it can be transported and stored in ways similar to more conventional fuels. It can be burned to produce high-temperature exhaust gases for power production and heating and can be used in largely existing transportation and utilization infrastructure, allowing the adoption of business models developed previously for conventional fossil fuels.

Current Market Fundamentals

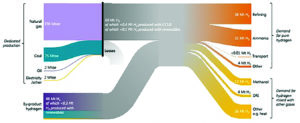

Today, hydrogen is supplied almost entirely from fossil fuels, with more than 70% generated from natural gas and around 27% generated from coal. Electricity as an energy input for electrolysis, accounts for less than 1% of the H2 production, with fossil fuels still indirectly accounting for the majority of this, due to the electricity for electrolysis being largely produced from fossil fuels in the countries where the hydrogen is produced.

In energy terms, the total annual hydrogen production worldwide is 70-73 million tonnes (metric tons) of hydrogen per year (MtH2/y). The hydrogen is produced in dedicated facilities, primarily located near the point of use, and its main uses are:

38 MtH2/y for upgrading petroleum products in refinery applications; and

31 MtH2/y as a feedstock for ammonia production.

In addition to this dedicated hydrogen demand, there is a further 45-48 MtH2/y produced as a byproduct from other processes, with main uses as:

12 MtH2/y for the manufacture of methanol;

4 MtH2/y in the manufacture of steel; and

26 MtH2/y for other applications such as synthesis gas for fuel or feedstock and process heating.

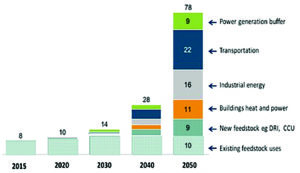

Forecast Increase in Global Hydrogen Demand through 2050 (Hydrogen Council 2017).

By 2050, total hydrogen demand could reach 650 MtH2/y, roughly five times the size of current production levels. Hydrogen would be used primarily for industrial feedstock and energy, together with transportation, heating and power in buildings, and power generation usage including hydrogen buffering.

Transportation represents the single largest potential market for hydrogen, at around 185 MtH2/y by 2050, representing nearly 30% of the total hydrogen. The primary use of hydrogen in transport is expected to be in fuel cell electric vehicles (FCEVs), where the main competition will be battery electric vehicles (BEVs). Both BEVs and FCEVs have no point of use emissions and thus offer the potential to significantly reduce local air pollution, especially in cities.

In terms of technology readiness, FCEVs are commercially available now or will become available in the next five years. There is also the need to further reduce costs and build up refueling station networks in parallel, if more auto-manufacturers are to be attracted to the FCEV market.

The number of hydrogen refueling stations worldwide has more than doubled in the last five years, marking the path toward more widespread commercial deployment.

The industrial sector comprising existing and emerging feedstock applications, and industrial energy is similar in size to the transport sector, comprising around 190 MtH2/y by 2050. Of this, ammonia manufacture would account for 44%, followed by methanol manufacture (20%) and refinery applications (14%). These sectors will grow at around 1%-4% per year to 2030.

Heating and power for buildings could account for 92 MtH2/y by 2050.

By 2050, hydrogen could provide 1,500 TWh of dispatchable power, representing 75 MtH2/y, with 500 TWh of excess solar and wind electricity converted to H2, representing 13 MtH2/y.

Hydrogen Production

H2 production from coal using gasification is a well-established technology, used for many decades by the chemical and fertilizer industries for production of ammonia, particularly in China.

In the gasification process, a hydrocarbon-rich feedstock, such as coal is heated at high temperatures to produce a syngas rich in hydrogen, carbon monoxide and CO2. The syngas can then be upgraded by converting the CO to CO2 and more hydrogen using the water gas shift reaction. The CO2 can then be separated using relatively mature physical absorption technologies such as Selexol and Rectisol, which means coal gasification can be a low carbon, hydrogen production technology. The process can produce a stream of hydrogen of around 99.8 % purity.

Globally, around 130 coal gasification plants are in operation with more than 80% of them in China. In terms of gasification with carbon capture, there are currently three facilities producing hydrogen from coal, coke and petroleum coke at scale, with a combined capacity of around 0.6 MtH2/y, namely Great Plains and Coffeyville in the USA and Sinopec Qila in China. These plants demonstrate that large-scale production of low emissions hydrogen using carbon capture can already be technically and commercially feasible.

Additionally important are the Latrobe Valley gasification pilot plant in Australia as part of the Hydrogen Energy Supply Chain (HESC) project that will see hydrogen produced in Australia shipped to the Kobe plant in Japan for ultilization. Also interesting for the future is the Pouakai proposed project in New Zealand, which integrates a natural gas-fired supercritical CO2 power cycle, known as the Allam cycle with an 8 Rivers steam methane reformer unit to produce H2. While this isn’t a coal-based demonstration, the earlier Net Power Allam Cycle demonstration in the USA showed that coal-based operation is feasible.

The largest clean hydrogen plant globally is the Great Plains Synfuel plant in North Dakota, USA, producing 1,300 t/d of H2 from the gasification of lignite. The plant produces synthetic natural gas (SNG) and anhydrous ammonia using 14 Lurgi Mark IV oxygen blown gasifiers.

The total cost for the design and construction of the plant was around $2 billion, which was designed with two product trains to improve plant availability, so that the plant can still operate at 50% capacity if one of the product trains is out of operation. The plant began operation in 1984, using 5 to 6 Mt of coal to produce around 1.5 billion m3 of SNG annually.

During the plant’s life, it has been modified to improve productivity, efficiency and reduce environmental impacts. In addition to plant upgrades to improve efficiency, the plant was also diversified to produce a wide range of secondary products. Ammonia scrubbers were added to the boilers to reduce sulfur emissions and enable the production of ammonium sulphate. In the 1990s, an anhydrous ammonia synthesis unit was added to produce anhydrous ammonia for fertilizer manufacture.

CCUS was added to the plant in 2000, capturing about 3 MtCO2/y, representing around 50% of the CO2 produced at the plant when running at full capacity. This is transported through a 330-km (205 mile) pipeline to Saskatchewan, Canada, to be used for enhanced oil recovery.

The HESC project is being developed in Victoria State, Australia, with the support of Japan. The project aims to develop and demonstrate technologies for the production, storage and transportation of clean hydrogen from lignite and to establish a supply chain through to utilization in Japan. The pilot phase encompasses a gasification plant in the Latrobe Valley and a liquefaction facility at the Port of Hastings. The A$500 million ($390 million) project is supported by the Japanese government and Japanese industry, together with the Australian and Victorian governments, which have each contributed A$50 million (around $39 million) in funding.

J-Power are leading the coal gasification and hydrogen refining facility, which started construction in November 2019 and began producing hydrogen in January 2021. The pilot phase will produce 5,000 t/y of hydrogen and 18,000 t/y of ammonia, which is planned to increase to 10 MtH2/y by 2030. The key project challenge is the cryogenic H2 shipments from Port of Hastings to Kobe, Japan.

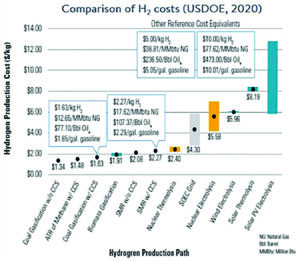

Comparison of H2 costs (US DOE 2020).

Cost Comparisons

A number of analyses have been carried out to assess the costs of hydrogen production. Notable among these are the International Energy Agency (IEA), International Renewable Energy Agency (IRENA); Committee on Climate Change, Hydrogen Council, Commonwealth Scientific and Industrial Research Organisation (CSIRO); and the U.S. Department of Energy (DOE). In these studies, hydrogen costs vary significantly with the production technology and other factors including:

Local factors due to the geographic region considered;

Fuel prices;

Renewable electricity price, either wind or solar photovoltaic (PV);

Capacity/load factors;

Learning rates for CCUS and water electrolysis systems; and

Carbon tax charged for residual CO2 emissions.

This means that direct comparisons are difficult to make due to the varying assumptions. However, in general, blue hydrogen production routes based on coal gasification with CCUS and natural gas SMR with CCUS are lower cost than green hydrogen based on water electrolysis, typically by a factor of around three. This would indicate that, with a large existing unabated fleet of gas and coal-based hydrogen production, the transition to large-scale low emissions hydrogen will require significant deployment of CCUS systems.

Given the economic advantage of coal gasification and natural gas reforming with CCUS, it is likely that these will continue to be the lowest cost source of large-scale hydrogen in the near and medium term. Hydrogen produced by coal gasification with CCUS vary from $1.6/kgH2 in China to around $2.1/kgH2 for coal/biomass/waste plastic with CCUS. These processes are highly dependent on the delivered feedstock price. Overall, the lowest cost technology appears to be that of autothermal reforming (ATR) of natural gas with CCUS, with a cost of around $1.5/kgH2.

In terms of the breakdown of the cost of hydrogen production from coal, in the case of China, capital expenditure (Capex) and operating costs (Opex) requirements account for around 80%-85% of the cost, with fuel accounting for the remaining 15%-20%. This reflects the relative complexity of the coal-gasification-based approach compared with SMR and electrolysis. The addition of the CCUS system contributes to around a 5% increase in Capex, with the largest cost addition being a 130% increase in Opex.

Researchers believe capital costs for coal gasification will decrease, with perhaps a 45%-50% reduction in Capex being possible by 2050 relative to the 2018 value.

Analysis by the Committee for Climate Change shows that for a new build case in the U.K., gasification plant would cost around £70/MWh ($97/MWh), including the costs of CCUS. Future savings from economies of scale could reduce this, lowering the cost of future coal gasification with CCUS by around 10%-15% to closer to £60/MWh ($83/MWh) by 2050. This cost assumes 95% carbon capture rate and a carbon tax by 2050 of £227/tCO2 ($315/tCO2), such that carbon costs account for 25% of the cost of hydrogen production.

The value of future carbon taxes is therefore a significant variable in the analysis of future hydrogen production costs and a potential risk to any investment decision.

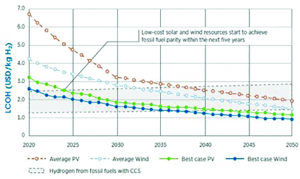

Cost of Green H2 compared with Blue H2 (IRENA 2019).

Costs of Blue vs. Green

In regions of the world with access to relatively low-cost renewable electricity, based on high wind or solar incidence, green hydrogen produced using water electrolysis could in time become a competitor with blue hydrogen from coal or natural gas. Potentially promising areas are Patagonia, New Zealand, Northern Africa, the Middle East, Mongolia, most of Australia, and parts of China and the USA. This would suggest that China and Australia in particular could be regions where water-electrolysis-based hydrogen production using renewable electricity could impinge on existing hydrogen production using coal gasification.

Focusing on the water electrolysis aspect of a study by IRENA, the forecast is for hydrogen from low-cost wind to start to be competitive with the upper range of fossil fuel-based hydrogen prices in less than five years, perhaps competing with the lowest cost fossil fuel-based technologies by 2035. Low-cost solar PV shows a similar cost reduction profile to wind, although this would be achieved slightly later in time than for low cost wind. For regions where wind and solar PV resources are closer to the global average, water-electrolysis-based technologies may not become competitive with the upper range of fossil fuel-based technologies until after 2030-2035. This suggests an important role for low-carbon fossil fuel-derived hydrogen into the medium term.

As the penetration of variable renewables in electricity systems increases, surplus electricity may be available at low cost. Producing hydrogen through electrolysis and storing the hydrogen for later use could be a way to take advantage of surplus electricity. The availability of low-cost renewable electricity is needed to ensure that electrolyzers can operate at relatively high full load hours. But if surplus electricity is only available on an occasional basis, it is unlikely to be commercially viable to rely on this for hydrogen production. Instead, operating the electrolyzer at higher full load hours and paying a higher price for the additional electricity could be preferable to using surplus electricity only. As the operating hours of the electrolyzer increases, electricity costs also increase. There is an optimum level of operation at around 3,000-6,000 equivalent full load hours per year. This means that hydrogen production from water electrolysis should operate “mid-merit” at around 35%-70% capacity factor. This may not be compatible with some applications of hydrogen such as industrial processes where a continuous supply of hydrogen may be required.

Additionally, water electrolysis needs 0.5 liters of potable water per kWh of hydrogen produced, which may be a scarce resource in some areas, although desalination can be an option for coastal locations.

Emissions Comparisons

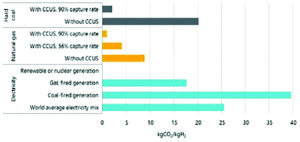

The estimated CO2 emissions per kilogram of hydrogen produced, or “carbon intensity,” of hydrogen from unabated coal gasification is 19 kgCO2/kgH2, which is around double the value of the carbon intensity from SMR of natural gas. This is, of course, an inherent feature of coal due to its higher carbon/hydrogen ratio of 0.1:1 compared with 4:1 for natural gas. However, when CCUS is added, this carbon intensity can be reduced to below 3 kgCO2/kgH2 based on 90% CO2 capture. There is the option to cofire coal with biomass and/or waste materials, which can further reduce the carbon intensity, or move to higher capture efficiency technologies.

In comparison, water electrolysis using renewable energy only is close to zero CO2, but where grid electricity is used, which contains a portion of fossil fuel-based power generation, emissions can be around 25 kgCO2/kgH2, which is higher than unabated coal. The outcome of this is that in terms of moving toward net zero emissions, the impact of using water electrolysis could be detrimental unless it is used at low capacity factor with mainly renewable electricity, or until renewables penetration of a region’s energy mix increases significantly such that the carbon intensity of grid electricity is reduced to a very low level.

A hydrogen producer could secure a “green” electricity mix through real-time power purchase agreements or perhaps real-time green certificates. The producer would then use the higher proportion of renewable-based electricity as a basis for calculating the carbon intensity of the hydrogen produced. However, analysis by DNV GL for example shows that

for water-electrolysis-based hydrogen production to deliver lower CO2 emissions than fossil fuels with CCUS, the carbon intensity of the energy mix would need to be lower than 75 gCO2/kWh, which would be significantly lower than the global average of close to 500 gCO2/kWh.

Another concern is that electricity from wind- or solar-based hydrogen production may displace the use of green electricity in the rest of the electricity system. As noted by the Global Carbon and Capture and Storage Institute, using renewable energy to replace fossil fuel-based generation, provides three to eight times as much abatement benefit as can be achieved by using renewable energy to make green hydrogen. Their conclusion is that the most effective way of moving toward a net zero future is to produce hydrogen from natural gas or coal with CCUS, while using renewables predominantly for electricity generation.

In summary, the total global hydrogen demand in 2018 was around 115 MtH2/y, which was produced local to the point of use, almost entirely from fossil fuels. This was used primarily as feedstock in the refinery and chemicals industries, with coal accounting for 27% of the hydrogen supply. Global demand for hydrogen is forecast to increase to perhaps as high as 650 MtH2/y, representing around 14% of the expected world total energy demand in 2050.

CO2 intensity of H2 production (IEA 2019).

Hydrogen production from fossil fuels with CCUS are lower cost than green hydrogen based on water electrolysis, typically by a factor of around three. Coal gasification with CCUS costs typically 1.6-2.1 $/kgH2 with lowest cost being that in China. Learning by doing through large-scale commercial roll-out together with cost reduction through technology innovations could reduce the cost by perhaps 10%-15% by 2050. In terms of emissions, the addition of CCUS at 90% capture rate can reduce the carbon intensity of this process to below 3 kgCO2/kgH2. Capture technology with increased capture rates approaching 100%, or technologies such as the Allam Cycle based on supercritical CO2 working fluid, should be explored in the medium to long term in the transition to 2050. Cofiring a portion of biomass or waste with the coal feedstock, coupled with CCUS could lead to net zero or even negative CO2/kgH2, which would help “future proof” the gasification plant.

Near-term actions are required to overcome barriers and reduce costs to increase the uptake of hydrogen, including policy actions to send positive long-term signals to potential investors. Overall, it seems clear that to produce low carbon hydrogen at scale, fossil fuel sources including coal, will continue to be needed in the medium to long term, particularly for industrial uses.