Allegheny Metallurgical’s new 1,400-ton-per-hour (tph) prep plant loaded its first train during February 2023.

Operators add capacity to process future production

By Steve Fiscor, Editor-in-Chief

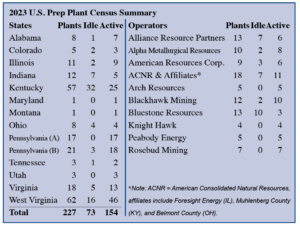

Coal markets softened during the summer of 2023, but activity continues on a steady course for most coal producers. Meanwhile, the medium- and long-term outlook for demand remains strong, especially for metallurgical coal markets. Those trends are reflected in Coal Age’s 2023 U.S. Prep Plant Census. This year’s tally identifies a total of 226 prep plants, 210 processing bituminous coal and 17 processing anthracite. A total of 73 bituminous prep plants are currently sitting idle, which puts the number of active bituminous plants at 154. Two plants were added and one plant was removed. Robindale Energy Services’ Laurel prep plant and Corsa Coal’s idled Rockwood plant, which were overlooked in the past, were added this year. Both are bituminous plants in Pennsylvania. American Consolidated Natural Resources’ Galatia prep plant in southern Illinois was demolished during 2022. Knowing idled prep plants may reopen and permits remain active, Coal Age carries prep plants in the census until they are demolished.

West Virginia leads with 46 active bituminous prep plants, followed by Kentucky (25), Pennsylvania (21), Virginia (13), Illinois (11) and Alabama (7).

Allegheny Metallurgical commissioned its High Carbon Processing prep plant in West Virginia during January. America’s newest facility, a 1,400-ton-per-hour (tph) greenfield plant, loaded its first train during February 2023. Longwall production is expected to begin soon.

CONSOL Energy commissioned its Itmann prep plant in West Virginia during December 2022. At the time, the mine was having problems securing enough room-and-pillar mining equipment to reach its expected design capacity. More recently, CONSOL Energy reported that the Itmann mine has transitioned from the development phase to operations, and the ramp up to full run-rate production was nearing completion. During the first half of 2023, the Itmann Mining Complex produced 134,000 tons of coal and sold 234,000 tons of Itmann and third-party coal in aggregate.

CONSOL Energy commissioned its Itmann prep plant in West Virginia during December 2022. At the time, the mine was having problems securing enough room-and-pillar mining equipment to reach its expected design capacity. More recently, CONSOL Energy reported that the Itmann mine has transitioned from the development phase to operations, and the ramp up to full run-rate production was nearing completion. During the first half of 2023, the Itmann Mining Complex produced 134,000 tons of coal and sold 234,000 tons of Itmann and third-party coal in aggregate.

Ramaco Resources successfully completed the expansion of the processing capacity at its Elk Creek prep plant during Q3 2023. The

$9 million project to boost production from 2.1 million tons per year (tpy) to 3 million tpy took more than a year to complete. The company said it expects by year end that it will have continuous operation at a 3-million-tpy run rate, which was first achieved during July 2023.

In August and September, the company reported that costs at the Elk Creek complex declined to just under $100/ton. For Q4 2023, given the increased capacity at the Elk Creek plant, the company anticipates that the mine costs will decline further.

The company had built more than 1 million tons in inventory during the first half of 2023 in anticipation of the increased processing capacity at the Elk Creek prep plant. The company said it is now in the process of converting this inventory to cash, which based on committed sales will show significant impact in Q4 2023.

As this edition was going to press, American Resources announced a plan to sell its coal operations. In April, the company said it had commissioned its McCoy Elkhorn processing facilities in Pike County, Kentucky. The McCoy Elkhorn processing complex has two onsite, state-of-the-art processing facilities, one with a 500-tph raw feed capacity and one with an 800-tph raw feed capacity, a unit train rail loadout on the CSX railway and two extensive refuse impoundments that have significant life and storage capacity.

Coronado Global Resources is adding coal storage capacity to the Buchanan prep plant in Virginia to accommodate additional coal from its expansion project, which includes adding a second longwall. That project was expected to be completed during Q4 2023.

Warrior Met began construction on its Blue Creek Complex, a new longwall installation, prep plant and coal handling facility. The company said the Blue Creek project remains on schedule with the first development tons from continuous miner units expected in Q3 2024 and the longwall scheduled to start up in Q2 2026.

The company estimated capital expenditures in 2023 for the development of the Blue Creek mine to be approximately $250 to $300 million and it recently said the facility is “advancing at a robust pace.” With nearly 70 million tons of recoverable reserves, Warrior Met said the Blue Creek mine will provide access to one of the largest untouched metallurgical coal reserves in North America for the next 50 years.

View Plant Charts here CA_pg12-19