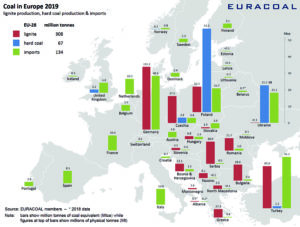

Figure 1B—European coal consumption varies by region.

Browbeaten by politics, the leaders are supporting their leap to renewable energy production with nuclear power

by judith schmitz

Brussels is leading the 27 European nations of the European Union (EU) toward a transition to a planned climate-neutral, carbon-free society by 2050. This process includes closing coal mines and coal-fired power plants. This strategy will be complicated as coal is still a pillar of European power production. These decisions seem to ignore the fact that these mines and power plants, and the stable, low-cost energy they produced, brought prosperity to European society and industry.

Coal mining has had a long tradition in Europe. It started on a large scale in the 12th century in Liège, Belgium, and Newcastle, England, spreading from there to other countries, reaching its highest peak in the 20th century. During that century, coal mining advanced to its highest technical level in Europe with the development, introduction and perfection of longwall mining methods in underground hard coal mines and large bucketwheel excavators and conveyor belt technology in open-cast lignite mines. The efficiency of coal power plants continuously improved along with emissions control technologies such as flue gas desulfurization (FGD) to eliminate SO2 and selective catalytic reduction for NOx. When a mining area closed, it was reclaimed and revegetated, resulting in high biodiversity or crop yield.

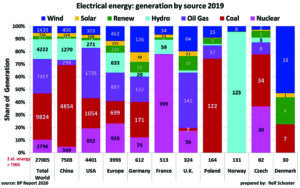

Figure 1A—There is still a broad mix of electrical energy sources in Europe.

Although other energy sources appeared in the 20th century like oil, gas and nuclear power plants, and the so-called renewables (starting early with hydro, followed by biomass, windmills, solar panels), nowadays, coal still plays an important role as an energy source in different European countries. In some of these countries, power production is still based on domestically mined coal and coal-fired power stations (See Figures 1A and 1B).

Even Germany, which has invested billions in renewable energy, cannot cope without coal as a source for electrical power generation at the moment. Hydro and biomass have almost reached their limits due to topography, limited amounts of rain and the way its agricultural area is shared. Bowing to political pressure, the country stopped mining hard coal at the end of 2018 and plans to do the same with lignite by 2038. In the next two years, it will not only close 13.5 gigawatts (GW) of net-installed coal-fired capacity, Germany will also stop nuclear power generation by the end of 2022. The latter is triggered by fear related to the incidents at Chernobyl in 1986 and Fukushima in 2011. Nevertheless, neighboring states, such as France and the Czech Republic, continue to rely on nuclear power as a primary electric energy source. The U.K. is constructing new nuclear power plants and the Netherlands and Poland are considering building new ones. Irrespective of the grand plan mentioned above, Germany opened a new coal-fired power plant this summer (Datteln IV; 1.1 GW), fed with foreign hard coal.

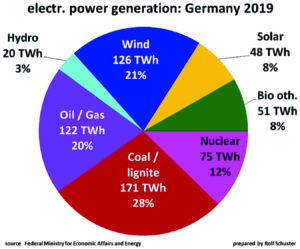

Figure 2—This pie chart shows the different energy sources that produce electricity in Germany.

In 2019, coal-fired power plants generated almost 30% of total electricity in Germany, the same order of magnitude as solar panels and wind mills (See Figure 2). The important difference is that coal power plants generate electricity efficiently and exactly when it is needed in contrast to wind mills (currently 29,456 units onshore, 1,469 units offshore) and solar panels that generate electricity even when it is not needed and vice versa (production over load and Dunkelflaute, no wind, no sun) (Figure 3 and Figure 4, e.g., January 24-25, 2019).

Meanwhile, Germany has the highest price for electricity in Europe (30.88 EuroCt/kW*h; European average is 20.5 EuroCt/kW*h). Owners of windmills and solar panels get a fixed price for 20 years paid by consumers as a form of subsidy for “green” electricity. This fixed price is independent from the demand for electricity and as such uncoupled from the actual market value of electric energy and thereby disturbing it. It is also paid when produced electricity yields negative price at the market e.g., due to an overproduction and must be exported in order to keep the grid stable.

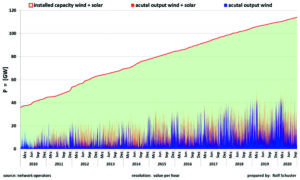

Figure 3—Windmills and solar panels produce energy unpredictable and independent of the load. As there is no storage possibility, they need to be supported by nuclear, coal, oil and gas. Note that without electricity added by windmills and solar panels, the conventional power plants could generate electricity efficiently 24/7 on a steady level. Challenging: In the grand plan, fossils have to be replaced by renewables for total primary energy production, thus not only in the relatively small sector of electrical energy production, but in almost all areas where energy is needed for modern human life.

The actual output of these renewables are lagging orders of magnitude behind the installed capacity (See Figure 4, light-blue area, red line). To the general public especially, the installed capacity is praised. In 2019, windmills and solar panels had an installed capacity of 109,858 MW, but for actual power, the lowest value was 500 MW, maximum value was 56,486 MW and on average, only 19,407 MW. Driven by this uncoupled system in which neither efficiency nor reliability plays a role, the installed capacity of these renewables will continue to increase as long as the system behind it does not change. The grid must be stabilized by reliable energy sources that can act in a timely manner.

Poland’s Rich Coal History

Poland is a traditional mining country with a large number of hard coal and lignite mines. Roughly 56 million metric tons (mt) of hard coal are produced from two main basins, Silesia (southwest) and Lublin (east). Another 50 million mt of lignite is mined from large open-cast mines in the middle of Poland. Earlier this year, due to the COVID-19 pandemic, several of the hard coal mines had to idle production, but they have since resumed production. In 2019, the country consumed 74% of its production for electric power generation. Note that hard coal production has been declining for years, although there are huge reserves of hard coal (22 billion mt) and lignite (1 billion mt). Instead, Poland imports hard coal from Russia, and also from the U.S., Australia and Colombia. Poland’s electricity price (13.4 EuroCt/kW*h) is low. Doing its best not to bow to political pressure, Poland said it will stop coal mining in 2049. There are plans for its first nuclear power plant to go online in 2033. The number of windmills is growing, mainly offshore in the Baltic Sea.

Figure 4—This graph shows (red line) the steady capacity increase of installed wind and sun power installations in Germany to more than 110 GW at present in addition to coal, nuclear and gas power plants, although only 70 GW are required to power the country. The contrast between the installed power and the actual power is startling: the second one has not been growing at the same rate and is highly volatile (the blue much smaller spikes represent power by wind mills, the red spikes power by solar panels and wind mills).

Czech Republic

The Czech Republic is the third largest coal producer in the EU. Coal is its only important indigenous energy resource. Coal reserves are estimated at 705 million mt, of which lignite accounts for 95%. In 2019, coal made up 41.8% of electrical power generation, while nuclear power was 35.4%. The country is home to the company Energetický a průmyslový holding, a.s. (EPH) that has become one of the large players for European electricity generating markets in recent years by acquiring many assets from other European countries. EPH operates hard coal power plants in Italy and in Germany (Mehrum, 690 MW, Schkopau power plant, LEAG the largest power plant operator in eastern Germany and owner of the large Lusatian lignite mines, the large mid-German lignite mining district including two large surface mines and power plants). In this way, EPH now controls two of the three large lignite mining districts and their power plants in Germany. The only producer of hard coal, the company OKD, which struggled from the COVID-19 outbreak, low coal prices and a decline in sales, will close two mines by February 2021. OKD will continue mining coal in its other mines for the time being.

The UK’s Carbon Neutrality

Although no longer a member of the EU, the United Kingdom plans to be carbon-neutral by 2050, too. The U.K. intends to phase-out all coal-fired power stations by 2025. The U.K. relies heavily on natural gas for generating electricity (on average, 41% of total generation, daily peaks are much higher, e.g., January 22 was 57%), followed by renewables (an annual average of 35%) and nuclear energy (17.4%) and a steady significant energy import from the continent (France and the Netherlands). Coal plays only a small part on average (2.1%), but is still important as a backup energy source (delivering 7% on September 15).

The demand of coal has been great in the cold and dark winter months of e.g., 2018-2019 or 2019-2020 when energy demand was higher and there was no significant amount of energy produced by windmills and solar panels. The daily average coal-based energy production increased to 5 GW. The role of coal and the other energy sources can be followed live on https://gridwatch.co.uk/.

In 2019, the U.K. produced 3 million mt of coal including high-quality anthracite mined underground in Wales and imported 10 million mt. Planning of a new coking coal drift mine focused on supplying the U.K. and European steel mills is under way in England’s Cumbria where the local planning authorities granted it recently, but the U.K. government is reconsidering the plans. Carbon capture, utilization and storage (CCUS) is seen by the U.K. government as an essential solution to meeting the U.K.’s net zero commitment and help the U.K. to become a world leader in the global market for low-carbon technology. The government’s main emphasis lies on offshore wind that shall be further expanded by 2030, ignoring critics saying the underlying economics of these renewables were disastrous not only for net employment, but also for energy prices as offshore wind seemed to remain an extremely expensive way of generating electricity.

So, will these plans succeed? Without large-scale energy storage, European society will not reap any benefits from the transition to renewable power. Once they discover the source of the metals used for the windmills and solar panels, they won’t be able to rid themselves of the environment guilt cast upon them by a handful of activists using a complicit media. Instead, inflated power prices will damage regional economies by increasing job losses in rural areas and causing manufacturers to shift to locations with dependable sources of low-cost energy.

Dr. Judith Schmitz is a freelance writer based in Germany (judschmitz@gmx.de).