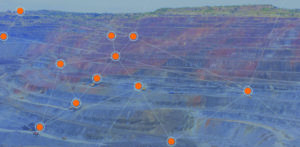

The fully autonomous mine will require vehicles to network with each other in order to intelligently respond to changing conditions and business drivers. (Photo: Wenco)

Autonomy is a powerful tool for driving productivity and efficiency in mine fleets and, if done right, can offer substantial cost reductions. Coal Age explores the path from FMS to AHS.

by carly leonida, european editor

Advances in GPS, wireless communications and cloud computing have greatly contributed to the evolution of fleet management system (FMS) capabilities in recent years. Through these and other correlative technologies, today’s FMSs can deliver greater accuracy, speed and data security, which translate into increased productivity, higher profits and fewer infrastructure-related overheads for mine operators.

Greg Lanz, vice president for business development at Modular Mining, said, “Another significant factor in FMS improvements is the proliferation of automation. Mines leveraging this technology are better able to reduce or eliminate human error, increase predictability within workflows, and decrease the frequency of personnel working in extreme conditions or hazardous environments.

“At present, utilization of automated technologies varies across the industry. At opposite ends of the spectrum are mines with little to no automation, and mines operating fully autonomous truck fleets. Situated between the two extremes are those using semiautomated and operator-assist technologies.”

The majority of open-pit mines globally use an FMS — DISPATCH, Wencomine and MineStar are just a few examples. There are many more available on the market. These are geared primarily toward the optimization of manned vehicle fleets, and many offer remote operation or semiautonomous functions for equipment like dozers, drills and excavators.

Haulage is currently the only part of the load and haul process that can be fully automated and to run a truck fleet, or part of one, autonomously requires an autonomous haulage system (AHS). Currently, there are three commercially available, with more in the pipeline. Caterpillar (Command for Hauling) and Komatsu (FrontRunner) are the leaders with solutions primarily targeted at their own fleets, the Cat AHS has been deployed on to Komatsu 930E trucks, too. Combined, these OEMs have deployed more than 400 autonomous trucks.

Hot on their heels is ASI Mining with its Mobius third-party OEM agnostic solution. Hitachi Construction Machinery (HCM) and Wenco Mining Systems are currently installing their first commercial scale AHS at Whitehaven’s Maules Creek coal mine in Australia following a proof-of-concept trial at Meandu in Queensland.

Despite 35 years of research and testing, commercial-scale deployments are still relatively thin on the ground. Fewer still are mines that are getting the full benefit from their investment in these technologies. Success with an autonomous fleet requires far more than just new software and hardware; a full transformation is required from mine planning to company culture with commitment at every level of the business, and change on this scale can be off putting, daunting even, for some companies.

Interest is Growing

While the largest and most successful AHS implementations are currently at iron ore operations in Australia’s Pilbara, many oil sands operations are now looking into converting their manned fleets to autonomous operation, too. Whitehaven’s Maules Creek mine in New South Wales will be the first coal operation to run an AHS once its new HCM-Wenco system is fully operational.

William Nassauer, manager for AHS product strategy at Komatsu, explained: “Komatsu has seen a 50% year-on-year increase in tons moved by our autonomous fleets over the last six years. The quantity and seriousness of inquiries that we are fielding have escalated as well and, early indications are that the upward trend will continue in the short-term despite current economic hardships.”

Many mining companies are now planning new mines in a way that will allow autonomous haulage to be used from day one, too.

“Making the transition from operators in trucks to an autonomous fleet is very challenging,” Wenco CEO Andrew Pyne said. “Many mining companies have completed economic and engineering evaluations required to potentially migrate their operations toward autonomous haulage. There are, however, significant barriers to adoption and, in some cases, it’s unachievable due to technological barriers, barriers in terms of the social impact of job losses, supplier and engineering challenges, and of course the CAPEX requirements to make the transition. This is why the adoption rate has been quite slow.”

The Interoperability Challenge

During June, Wenco and U.K.-based autonomous technology provider Oxbotica announced they had signed a Memorandum of Understanding (MOU) to develop an open autonomy solution for mining.

Oxbotica was founded in 2014 at the University of Oxford to develop an autonomy software platform that enables faster deployment of industry-specific autonomy applications. Its mining solutions combine advanced robotics, artificial intelligence and computer vision to change the way vehicle fleets operate.

The companies said the open autonomy solution they are working on will provide customers flexibility and efficiency in the deployment of autonomous mining equipment, allowing them to operate any open standard-based vehicle and integrate it into their existing fleet.

This approach avoids vendor lock-in and offers customers the freedom to choose preferred technologies, independent of their primary industrial systems. Furthermore, it enables highly skilled autonomy suppliers that may be new to mining to integrate with customers’ existing operations while backed by a proven expert in the industry.

“We are very excited to be working with Oxbotica,” Pyne said. “Autonomy version 1.0 is well understood for its benefits but also its limitations, and a number of mining companies are now looking at how to overcome those.

“For a period of time, Caterpillar and Komatsu were calling the shots on what autonomy meant in terms of commitment to them as a supplier. Mining companies wanted the benefits of autonomy, but they also wanted more flexibility, so it was really a catch 22.

“The catalyst for us, and why we started to invest in and champion open autonomy in 2017, was one of our large customers challenged us. Their CIO said that if we didn’t get active in trying different approaches, we would be displaced because they had to go with a full stack approach. They had a mixed fleet at the time.

“That open approach became very much part of our company strategy, and also HCM’s approach as we recognize the benefits this approach will provide to our customers. HCM is primarily an excavator company so, if a mine was going autonomous with Komatsu or Caterpillar, that really diminished the opportunity for excavator sales. It made sense for Wenco and it allowed us to link our objective to HCM’s.”

According to statistics from GlobeData’s Mining Intelligence Center, the number of autonomous haul trucks globally is expected to grow by more than 300% by 2023.

“One of the main reasons we only have 2% autonomous trucks in mining at the moment is because there are barriers that a lot of mining companies can’t get past and they’re frustrated,” Pyne said.

“We approached Oxbotica because we saw a technical advantage over what was currently in place, particularly around obstacle detection for AHS,” he said. “One of the limitations of first-generation AHSs is obstacle detection and safety; false detections can have a massive impact on mine productivity.

The deal with Oxbotica made sense. The company could provide a critical portion of technology that is needed to create a full autonomy solution and, most importantly, its systems are truly interoperable.

For mines that are already operational, this approach could offer them a chance to integrate an AHS into a mixed-brand fleet of trucks and keep their current FMS, rather than switching out trucks or an FMS for those that are compatible with the AHS they want to use.

It’s hard to quantify what this could mean in terms of financial savings for mining companies as every scenario is different. However, it’s reasonable to assume that the cost reduction for an overall solution will be significant.

Managing Change

At present, if a mine wishes to convert its manned truck fleet to autonomous operation, and, if the FMS it uses across the mine site isn’t compatible with an AHS (i.e., the Cat MineStar FMS is compatible with Cat Command for Hauling AHS, Modular Mining’s DISPATCH system is compatible with Komatsu’s FrontRunner AHS etc.), then it has to switch FMS as well. This makes the implementation process far more costly and time consuming, and change management tricky for staff.

For example, Newmont’s Boddington gold mine in Australia currently uses Hexagon’s Jigsaw system, but, as Jigsaw doesn’t support Command for Hauling, it will be replaced by Cat’s MineStar system as part of the ongoing project to convert the mine’s 39-unit Cat 793 fleet to autonomous operation. Boddington’s drills will remain on Jigsaw though as this system provides very accurate drilling in combination with the Locata ground-based GPS system that Boddington uses around its pits. Locata is necessary given the pits’ depth, the steep angle of their walls, pit orientation, and the mine’s southerly latitude — all make for poor GPS coverage up against the walls for the drills.

Newmont has said publicly that this was one of the biggest challenges in the mine’s decision to switch to an AHS. Changing a FMS is not an easy task, even without autonomy, and running the two in parallel will be a major undertaking.

And this is not a one-off situation: Fortescue also switched out the FMS at its Cloudbreak iron ore mine in Australia as part of the move to autonomy, as did Imperial Oil at its operations in Canada.

Speaking of change… an AHS is often thought of as a FMS for autonomous trucks, however, consultant Richard Price gives a more accurate and holistic description in his 2017 article “Autonomous Haulage Systems — the Business Case” for AusIMM Bulletin.

“There is no industry standard definition of an AHS. It is referred to as the people, technological devices, infrastructure and software that combine to create a system allowing off-highway haul trucks to operate without truck drivers” he stated.

People are the key component here. Company culture and willingness to change business processes and systems in order to make the most of the technology underpins every other aspect in the successful planning and execution of an AHS project.

“When transitioning to an AHS environment, mines need to institute a cultural transformation,” Nassauer said. “Mines cannot continue to think and act in the same manner as for conventional operation; the autonomous environment requires a more disciplined mindset. Overcoming this barrier requires a great deal of effort, training, and determination by employees at all levels and in all roles across the board. Being ready for change as an organization is the starting point; choosing an experienced technology partner is key to a successful transformation.”

The fully autonomous mine will require vehicles to network with each other in order to intelligently respond to changing conditions and business drivers. (Photo: Wenco)

Better Communications

Another crucial piece of the puzzle is the communications network that a mine uses and its data transfer capabilities.

Nassauer said LTE has been working its way into mainstream adoption at many of Komatsu’s AHS sites.

“This has brought about new levels of stability and provided tools that allow us to tightly manage security and assure a degree of service previously unobtainable with Wi-Fi,” he said. “We are keeping a close watch on the emerging 5G technology. It has the potential to enable massive instrumentation and analytics and open up as-yet undiscovered avenues for product improvement and downstream innovation.”

Pyne stated otherwise though: “I don’t believe [5G] will affect the performance of FMSs or the next generation of AHSs much,” he said. “Better communication technology will provide lower cost of ownership, which may yield more deployments if the ROI is more positive. It will also allow the use of more devices that produce data. This can further be analyzed to build better models and help optimize the mine’s operations.

“We predict that AHS technology will become more sophisticated and rely less on real-time, mine-wide communications as the technology matures, and enable new innovative entrants to provide next-generation AHS solutions. So, AHS performance will grow less dependent on 5G or low latency communication as time goes by.”

It’s likely an increase in the networking capability of autonomous vehicles will be seen in the coming years and the integration of artificial intelligence, as mines look to improve the efficiency and independence of their AHS.

HCM recently announced it has selected Rajant’s Kinetic Mesh network to support the AHS at Maules Creek. The industrial wireless network enables vehicle-to-vehicle (V2V) communication, which allows autonomous vehicles to talk directly to each other, providing enhanced coverage and reliability.

Better V2V communication will eventually allow the use of large fleets of smaller, fully autonomous trucks like Volvo’s HX2, Scania’s AXL or Komatsu’s Innovative Autonomous Haulage Vehicle — cabless trucks capable of operating in a swarm-like fashion, redeploying themselves immediately in response to changes in the mine plan or operating conditions.

In essence, the autonomy shift is indisputable. However, the paradigm of closed systems has to change to make the technology more widely accessible, and for the industry, as a whole, to take the next steps toward building “mines of the future.”

This article combines excerpts from a similar article that appeared in the June 2020 edition of E&MJ with the June Wenco-Oxbotica announcement.