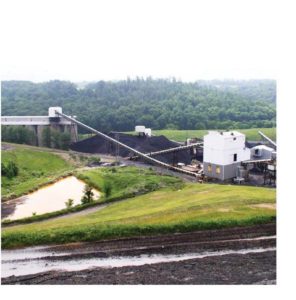

Rhino Resources enters into a stalking horse purchase agreement to sell nearly all of its assets. (Photo: Rhino Resource Partners)

Rhino Resource Partners LP, along with its subsidiaries and certain affiliates, has filed for relief under Chapter 11 in the U.S. Bankruptcy Court for the Southern District of Ohio. Rhino has obtained $11.75 million of post-petition financing and the support from a stalking horse bidder to acquire the company. Rhino said it will use the bankruptcy process to implement a sale of substantially all of its assets to maximize value for its stakeholders.

“Rhino has been taking steps to improve both the performance and financial strength of our business,” Rhino CEO Rick Boone said. “While these strategies have gained positive momentum, they have not produced sufficient liquidity to continue operating our business and servicing our outstanding obligations.”

Boone said the company has entered into a stalking horse purchase agreement. The stalking horse bid is a baseline against “which we will seek higher or otherwise better outcomes for the benefit of all of our stakeholders,” he added.

The $11.75 million debtor-in-possession loan from its prepetition lenders will provide Rhino with liquidity necessary to operate its business while it pursues a value-maximizing transaction through the Chapter 11 process.

Rhino filed a motion on July 22 to authorize the execution of the asset purchase agreement with the stalking horse bidder and approve its sale process. Interested parties will have an opportunity to submit higher or otherwise better offers through the court-supervised competitive bidding process. Rhino has retained Energy Ventures Analysis, Inc. as its financial advisor to assist with the sale process.

Rhino is seeking court approval to continue employee wages and benefits without interruption; and pay for goods and services provided to the company during the bankruptcy process.

Rhino has made customary filings with the court, including first-day motions, to help ensure an orderly transition into Chapter 11 while minimizing business disruption.

Rhino operates two mining complexes in Central Appalachia, Tug River and Rob Fork, one mining complex located in Northern Appalachia, Hopedale, and one mine located in the Western bituminous region in Utah, Castle Valley.