| Coal handling terminal at Vostochny Port near Vladivostok, Russia. |

The territory of Primorsky Krai (Region) holds an advantageous position for exporting coal into the Pacific Rim. It’s an ice-free access to the markets of China, Japan and other Asian countries that is roughly 4,000 miles closer to Asian destination ports than competing coal export ports in North America. The main coal producing region, Kuzbass, produces coking coals and a wide variety of steam coals. For this reason, Primorsky Krai is attractive to coal exporting investments. Numerous investment groups intend to increase the tonnage exported into the Pacific Rim by 2020.

The main weakness of Kuzbass exports is the inadequate rail system and the rail distance from port. From Kemerovo, the modernized heart of Kuzbass, to the main coal exporting terminal at Vostochny is 3,400 miles, which is much farther than the distance from Vostochny to any of the Asian sea ports. Other coal reserves, such as Neryungri, exist much closer to Vostochny (1,400 miles). Coal reserves in Russia’s Far East are under intense scrutiny and development today. Three ports in Primorsky Krai account for some 40% of all coal exports of the country: Vostochny, Vanino and Nadhodka.

Japan’s 1992 Coal Manual describes two Russian coal loading ports: Vostochny Port (Vrangel Bay) and nearby Nakhodka Port. While port brochures say the ports are ice-free, the manual stated that up to 0.5 m of ice can build up around the piers in mid-winter. It is likely both statements are correct, suggesting a buildup of ice around the piers, but not enough ice to prevent safe passage without icebreakers.

Vostochny Port handled more than 15 million tons of cargoes from January through October 2012, 7.5% higher than the results of the same period in 2011. The main cargo is the coal mined in the Kuzbass Basin west of Lake Baikal near Kemerovo. Export coal is presently almost 98% of the company’s whole cargo turnover. Another 1.8% is coastwise coal, and about 0.2% falls on other cargoes.

Vostochny Port JSC (Joint Stock Company) is the largest stevedoring company specializing in coal handling. It consists of two terminals. The first terminal is called the Coal Handling Terminal. It has a coal conveyor system and a railcar unloading station. Automation level is up to 99% at this terminal, and handling capacity is currently rated at 14.2 million tons per year. Nearly 12 million tons of coal were handled at the Coal Handling Terminal from January through October 2012, an increase of 4.7% over the same period in 2011.

The other terminal is the Universal Handling Terminal, which specializes in clamshell coal handling. The capacity of this terminal is about 3 million tons per year. For the January through October 2012 period, 3 million tons of cargo were handled at the Universal Handling Terminal, 20.2% more than the previous year for the same period. This terminal specializes in loading smaller vessels have access to only the shallow draft or smaller terminals.

Vostochny Port is located in the south of the Primorsky Region, southeast of Nakhodka Bay in Vrangel Bay. This is a unique natural harbor with no ice restrictions, even in severe winters. The natural depths up to 22 m in the navigating channel are enough to accommodate vessels of 150,000 tons deadweight. Due to steeply sloping shores and absence of settlements close to the port, it provides unique opportunities for further development.

Vostochny Port is joined with most important main roads of Russia by a highway and a railway. The pre-port railway station Nakhodka-Vostochny connects the port with the Trans-Siberian Railway, which together with Vostochny Port forms the unique transport bridge between Europe and Asia.

A new shiploader manufactured by Mitsui Miike (Japan) commenced operation at the Capesize berth of the Vostochny coal terminal. The new equipment was put into operation on November 1, 2013, upon completion of startup and adjustment works. The shiploader operates at Berth No. 49 handling capesize class vessels. Nominal capacity of the new equipment is 3,000 metric tons per hour (mtph). It can handle large capacity vessels of up to 45 m beam.

As of today, export coal (mainly coal mined in the Kuzbass region) accounts for 98.5% of the company’s turnover; the remaining 1.5% is going to the coastal trade. The company’s assets include a Specialized Coal Terminal with conveyer equipment system and railcar unloading station and the Universal Handling Terminal, JSC Vostochny Port operates a fleet of harbor tugs able to berth 150, 000 dwt ships.

|

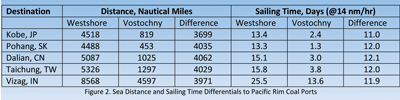

| Table 1 — Sea distance and sailing time differentials to Pacific Rim coal ports. |

Vostochny Ocean Freight Advantage

In 2012, tonnage exported via Vostochny Port was split between primary customers Japan (31%), Korea (30%) and China (27%), with smaller quantities going to Taiwan (8%), India (2%) and the Netherlands (2%). Because of its proximity to Pacific Rim coal destinations, Vostochny and other Far East Russian ports have a huge ocean freight advantage over North American west coast coal port locations. The following comparison shows the freight advantage of Vostochny over Canadian port Westshore Terminal.

The distance differential of approximately 4,000 nautical miles to most Pacific Rim destinations equates to an average time differential of about 12 days. The 2014 Platou Report reported the following daily trip charter rates for 2013: capesize-$16,600; Panamax-$9,500; eupramax-$10,300; handysize-$8,200. Applying these numbers to the sailing time differentials shows the capesize vessel costs the North American charterer almost $200,000 more to deliver the same cargo tonnage to these destinations.

New Coal Port Development

When the USSR dissolved in December 1991, the Soviet Union disintegrated into 15 separate countries, leaving Russia with very few ports. Recognizing the importance of export capabilities, Russia has placed heavy emphasis on regaining or improving access to ice-free ports (e.g., Crimea and Vostochny), building new ports, and expanding/modernizing existing ones.

President of Russia Vladimir Putin has declared a goal to increase coal output 30% by 2030. Since Russia has the second largest proven coal reserves, and is not greatly troubled by environmental interference, this does not seem like an overly ambitious goal. Currently the country accounts for 4.5% of global coal production, but only 13% is used for domestic power generation. However, Russia is keenly aware that 68% of China’s power generation will be coal-fired by 2020, and Russia has plenty of the high-quality coals that China will require. According to Putin, the shareholders decided to give a status of “public” sea terminal to the third phase of Vostochny Port’s Coal terminal. It is intended for operation with large, medium and small size shippers.

|

| Table 2 — Coal terminal projects announced by Russia. |

In January 2013, Mechel acquired a controlling stake in Vanino Sea Trade Port OAO for about $512.5 million. The Government of the Russian Federation in December 2012 issued a decree related to the sale of federally owned shares of the port company and Mechel was declared the buyer. The company purchased 55% of share capital of Vanino. Port Vanino is one of Russia’s 10 largest ports. Port Vanino’s coal transhipment capacity increased to 7 million tons in 2013 without incurring any significant costs. Suek, KRU, SDS and Mechel account for about 65% of Russia’s coal exports, which in 2011 were about 110 million mt of steam coal and 14.2 million mt of coking coal. Japan received 13 million mt Russian coal in 2012.

The third phase will be a continuation of the coal terminal. The project implies the construction of railway infrastructure, additional berth with two ship loaders, conveyer equipment system, two rotor-type tandem wagon dumpers, wagon defrosters, as well as creation of four additional storage facilities equipped with four reclaimers and two stackers.

The construction site of the third phase was initially surrounded with the seashore (in the east), highway (in the west) and existing coal terminal (in the south). The reserve of storage space is always required to ensure success of stevedoring business. Therefore, the management company of Vostochny Port decided to reclaim more territory for additional storage facilities. Under the project, the capacity of four storage facilities will be 800,000 tons of coal, which is almost one fourth more as compared with the existing coal complex of the company. Design supervision of the construction is being carried out by DNIIMF.

With the reclaimed territory, the shore area will be extended for more than 400 m. Apart from the storage facilities, two berths will be built there. The first one, Berth No. 51, will be 93 m long. During the construction period, it will accept technological equipment of the third phase. The depth at the berth will be 11.5 m, which is sufficient for vessels currently handled at the Universal Handling Terminal.

The second berth, No. 51, will be 300 m long and 16.5 m deep at the berth wall to accept large capacity vessels up to 150,000 dwt. The construction of Berth No. 51 was commenced in October 2013 by Construction Alliance CJSC. According to the agreement, the facility will be delivered in summer 2014.

The construction of the third phase commenced in October 2012. The project is to be completed within 48 months. Its estimated value is almost $28 million. According to the forecasts of Managing Port Co. LLC, coordinating the operation of the largest port operator, the port capacity is to reach 24.5 million mt of coal by 2017 and 28.5 million mt by 2019. With Phase III fully operational in 2020, Vostochny Port OJSC should be able to handle up to 32.5 million mt.

Considerable growth of Vostochny Port OJSC will be driven not only by Phase III of the coal complex, said Managing Director of Vostochny Port OJSC Anatoly Lazarev. In 2010, they started implementing the program in improvement of operation technology and renovation and modernization of equipment. This program is to be implemented within five years. One of the latest acquisitions is the ship loader.

The program on modernization and implementation of Phase III consists of several stages complying with the strategy for the development of seaport infrastructure of the Russian Federation until 2030. One of the purposes of the strategy is to enhance the capacity of seaports.

RUSSIAN Railways (RZD) may have to double funding for proposed improvements to the Trans-Siberian and Baikal — Amur railways to better serve the growing volumes of coal being transported from the Kuznetsk Basin, the biggest production site in Western Siberia, according to the Russian Institute of Economy and Transport Development.

A report issued by the RZD-sponsored think tank stated that to meet demand, investments of around $34 billion will be required on the two lines up to 2020. This is twice the amount approved by the Russian cabinet in April. The report estimates that RZD will be transporting 71.8 million mt of coal on the two corridors in 2020, double the 32.5 million mt carried in 2012.

According to The Moscow Times, a recent audit by Deloitte, PwC and Ernst & Young identified billions of dollars of possible savings in the reconstruction plan of the two corridors, while it stated that RZD had overestimated volumes on the two lines over the next seven years by 25 million mt.

The president of Russia website reported that Putin held a meeting on July 26, 2013, for the purpose of reconstructing and modernizing the Trans-Siberian railway, and declared the Russian government would invest around $14 billion from the National Prosperity Fund to get three rail projects under way. The Moscow Times stated on February 2, 2014, it may not be able to transport growing amounts of coal from the Kuznetsk Basin, the biggest production site in Western Siberia, Russian Railways proposed to double investment into modernizing the Trans-Siberian and Baikal-Amur railroads, the latter serving the Far East ports.

A professional engineer and coal consultant with transportation experience, Dave Gambrel writes articles for Coal Age and Engineering & Mining Journal (E&MJ) that offer miners advice on transporting commodities to markets. He may be reached at bunkgambrel@earthlink.net.